Written by: Terrell Gates | Virtus Real Estate Capital

I’m guessing most of you by now have eased into your new way of living and working. Although this creates some real challenges for all of us, I’m trying each day to remain grateful for having it so good in the midst of the crisis, and empathetic for those who do not. I’m also focusing on the silver linings, such as being able to spend more time with my wife and children, connecting with more friends and new relationships, and generally being more present, even if that presence is via video conference. I hope you, too, see this as an opportunity to pause (or at least slow down) and appreciate all the blessings we have. I also remain forever grateful for all the first responders and other workers on the front lines of this fight, many of whom live and work in our properties throughout the country.

In our first and second letters, we provided commentary on various CRE property types amid the crisis. In this letter, we’ll provide another update on the CRE markets and identify emerging or differing trends we’re seeing on the ground in our targeted property types.

Current View and Base Case Going Forward

In just the few weeks since our last letter was produced, equity markets have rebounded, putting up gains we haven’t seen since the 1970s; the government has approved the largest ever series of stimulus packages; a record 22 million Americans have filed for unemployment benefits, and government officials have begun plans for ending the quarantine. A few weeks feels like a lifetime ago since our last letter.

As we previously wrote, we expect to be in this period of suppression for at least the next several weeks, and then the “dance” for several months after that. The timing of suppression subsiding will be based on regional conditions and event horizons. The real question is, what happens during the dance? Throughout this entire crisis, I’ve wondered what happens after the “curve is flattened” during quarantine? The presumption is cases will go back up as a result of the populace returning to at least some semblance of normal life, with greater physical integration and increased probability of contracting the virus. There are many theories out there, and it’s not my place to venture a guess. What I can venture a guess at is the different periods from here and what that means for commercial real estate.

I. Suppression (aka-the Hammer): In most places, this period will likely end in this quarter. The only Commercial Real Estate (“CRE”) transactions getting done are those that were already fully baked with hard earnest money up and were being purchased all cash or with debt from the few lenders still lending, like the Agencies (Fannie Mae and Freddie Mac). There may be a few distressed transactions taking place where the properties already had acute problems. However, currently, most lenders are not moving against borrowers on non-performing or under-performing loans. Transaction volume will be at record lows. Property performance and rent collections will be down across all property types, but the pain will be most felt in high-beta asset classes like retail, hospitality, and office.

II. New Temporary Normal (aka-the Dance): Presumably, this period will begin by 3Q20 or sooner, will likely last for at least several quarters, and could potentially go through the end of 2021. Beginning with the 2Q20 marks (usually out in August) and likely enduring throughout the dance, Net Asset Values will be down for most investors and investment managers. There will remain a wide bid-ask spread between buyers and sellers of CRE, but that spread will narrow over time based on lender activity, the health of the capital markets, the employment environment, and especially the market’s view on the timing to a long-term new normal. Whether COVID-19’s trajectory (and the economy’s for that matter) behaves like a U, W, or a double-W will dictate the timing of this period and the market’s view of investment opportunity overall. Regardless of the answer, we expect that distressed acquisitions will increase toward the end of this period, especially for properties that were already struggling prior to the outbreak. Transaction volume will increase but will still be tepid by historical standards. Property performance will remain challenged with increases in longer-term tenant delinquencies, loss to lease, and general vacancies, especially in the “basic food group” (office, retail, hospitality, industrial, and multifamily) with many landlords having to reboot business plans or forfeit assets. Any short-term challenges to healthcare, education, self-storage, or workforce housing assets experienced during suppression will likely subside during the dance as operations return to normal, and demand inures for these segments.

III. New Long-term Normal: There will be changes to how we do business and how we interact with each other, but there will be a return to some sense of normal life. COVID will likely be viewed as the flu or similar, it will be a nuisance to be dealt with on an ongoing basis, but it will no longer rule our daily lives. Credit and capital markets will still struggle during the aftermath as a result of the economic impact of the crisis, but the volatility to credit and capital markets will subside. It is doubtful that the pre-COVID peaks in the capital markets will be seen again for the foreseeable future, at least for any meaningful period. For CRE, market and specific deal dislocations will be common, and the disparity in performance will widen with clear winners and losers, based on property segment allocation, market selection, operational execution, and capital structure. Property performance and fundamentals in healthcare, education, storage, and workforce housing will likely be robust, and investor appetite for these more resilient sectors will increase, at least on a relative and perhaps even an absolute basis.

Our response as a firm has been to use our extra bandwidth during this period of suppression to (1) plant seeds for future distressed acquisitions; (2) bring forward longer-term research projects; (3) optimize systems, policies and procedures; and (4) focus additional team members on managing our existing portfolio of assets.

Investor Appetite for CRE

In talking to numerous investors, consultants, and advisors around the globe over the last six weeks, there seem to be three categories of investor responses emerging. There are investors who are sidelined from making new investments for the foreseeable future, due to liquidity concerns, an existing overweight to high-beta CRE assets, or the denominator effect has halted new CRE investments due to the reduction in value of stocks, energy and likely private equity to come. Another group of investors has emerged who are pausing new investments in the short-term, but once they have a view on the post-suppression new normal, they expect to be back to at least a semi-normal investment pacing plan. They generally view CRE as a favored asset class relative to others in the coming investment environment. The last category of investors are those who see this as an excellent opportunity to put capital to work. They’re either trying to source secondary LP transactions from the first group of sidelined investors, or they’re seeking investment managers who have experience executing distressed, turnaround, or other opportunistic strategies.

Fundraising has virtually halted during suppression, other than with investors who were already well along in their diligence process or were trying to commit capital in preparation for the distress to come. Fundraising will undoubtedly increase during the dance, but will still be limited, likely at a meaningful reduction from the peaks we’ve seen. After the Dance, when some longer-term normalcy has returned, some might argue that CRE fundraising could be as robust as it was a few years ago because investors will be especially desirous of the income, stability, and inflation protection (especially with trillions in stimulus pushed into the system) that CRE provides. I think it’s unlikely we will return to those levels any time soon, but I do believe that investors will be more selective and specific about targeting certain property types over others.

Virtus Targeted Property Types

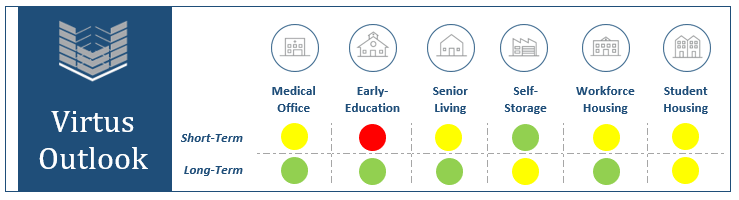

We feel very fortunate to have been invested in the cycle-resilient asset classes during this period and the periods to come. We will no doubt have some short-term pain in terms of collections and related from tenants, but the intermediate and long-term fundamentals of these properties are at least neutral to pre-crisis, and in some cases, supply and demand fundamentals are likely to improve.

What follows is our short- and long-term expectations for each of our targeted property types:

Medical Office (“MOB”)

Will struggle in the short-term with collections because the majority of major metro jurisdictions have ordered that all non-essential medical procedures be postponed indefinitely to create the capacity to deal with the pandemic. As such, a number of MOB tenants, such as orthopedists, dermatologists, pediatricians, dentists, cosmetic surgeons, and a host of other elective-based providers are effectively shut down during quarantine. This, combined with having several assets in jurisdictions where the local government is preventing evictions, has led to a lower rent collection rate for April thus far. In addition, the health systems are especially struggling during the quarantine, because all of their high margin business from elective procedures and the like is effectively non-existent, while their low margin and unprofitable business, such as COVID and emergency room treatments, have increased substantially. Fortunately for the health systems and many of the tenants in our buildings, states are beginning to allow healthcare providers to provide these services so long as capacity remains in the system to treat the virus.

We’re fortunate that these businesses will likely return to full force after suppression ends, although it will be in phases over time. These tenants have the wherewithal to make their rent payments because of reserves and the fact that rent is a smaller percentage of revenue and profits than it is for the typical retail or office tenant. Further, tenants rarely default because their switching costs are so high, and they have a lot invested in the specialized build-out of their space. Telemedicine, wearables, and other virtual healthcare delivery mediums will certainly increase, which is most welcome. However, demand for built space should remain robust, given the Baby Boomer demographic is only now beginning to reach the peak ages of when healthcare needs multiply. While demand in the intermediate and long-term remain robust, there’s minimal new supply coming online. Virtus will continue to focus on acquiring underperforming assets with higher yields and keep our eyes peeled for capital structure distressed opportunities.

Early-ed Properties

Almost all early-ed schools have been forced to close across the country, with only a few remaining open to serve the children of first responders. Most will only collect a fraction of the revenue for April that they were expecting. Although this will cause short-term pain, we see no impairment of value, because the schools are expected to return to full capacity once the quarantine is lifted.

Although early-ed operators will experience cash flow issues during this period of suppression and likely for a short period after that, we see no fundamental headwinds for the space long-term. The number of single-parent households, dual-income households, and women in the workplace have been growing for many years with no signs of abatement in the future once we are past this initial period of forced closures.

Senior Living (“SL”)

Although collection percentages are relatively high, SL will struggle in the short-term, because these are the highest risk residents for the disease and it’s extremely difficult to lease new units during the lockdown. Contrary to some of the recent popular media assertions, high-quality senior living communities are the best place for the elderly during a crisis such as this. They can receive great care from trained professionals, quality food, and much needed socialization and programming, all in high-quality built space.

The COVID crisis ironically has the potential of benefiting senior living. The two biggest challenges that have been facing SL prior to the crisis have been new supply and labor shortages. New supply will abate at least temporarily, and those who have lost their jobs in more volatile industries like retail, hospitality, and food and beverage may provide an increased labor pool for SL communities. Once it is clear that quality senior living communities are the best place for loved ones in need, there is likely to be an increase, or at a minimum, a stabilization in demand. We will look to acquire attractive needs-based assets at compelling valuations from owners and operators who were already struggling before the outbreak, as well as focus on solving the affordability challenges that will be facing the wave of Boomers needing housing in the coming years.

Self-Storage

Currently has the highest collection rates short-term due to the preponderance of tenants being on auto-debit. Further, these rent payments tend to be a small amount relative to other expenses incurred, and there is no government mandated eviction relief for tenants, as there is in other property types.

Having said that, for some users, storage is not a needs-based use. Some of those tenants will terminate or default. During the Global Financial Crisis (“GFC”), we saw loss to lease increase from these more discretionary tenants, but we also saw an increase in demand from needs-based tenants, such as residential tenants who were forced to move or downsize, or from commercial tenants who were downsizing from their industrial or flex office space. With increases in rental rates, collected income was effectively flat, even during the worst of the GFC. Although that bodes well for performance during downturns, there is presently a lot more storage supply in certain markets than there was during the GFC, so absorption during a continued downturn will be a question mark. We expect to buy distressed assets from smaller owners and in high growth but temporarily over-supplied markets.

Workforce Housing (“WFH”)

Although our April collections were strong across our WFH portfolio, including outpacing national multifamily collection rates as of this writing, collections in May and perhaps June will likely decrease as certain tenants, especially blue-collar tenants, who have lost their jobs or been furloughed will struggle to pay rent. There will be some offset to this due to the individual payments from the stimulus package being made to middle- and lower-income American households. In addition, most of our properties target grey collar tenants whose professions are generally in high demand currently (nurses, first responders, military, and other healthcare professionals), and they should be relatively immune to financial distress during this period of quarantine. In the meantime, we’re delaying property improvements for a few months until we’re past suppression and have a view on the dance to come. There are still some transactions taking place, but it’s minimal. Although the Agencies are still lending, they require fairly draconian reserves, and their spreads have widened. That combined with near-term collections and other factors have slowed transaction volume significantly.

The long-term outlook is quite positive. There’s virtually no new supply being built, and aspirational renters who have been stretching to access higher cost luxury multifamily will likely target more affordable middle-income housing. To date, the number one reason tenants, especially grey collar tenants, move out of our WFH properties has been to buy a home. That will almost certainly decrease during the coming environment as disposable income necessary for a down payment will be stressed, and lending standards will further tighten. We expect the 43 million U.S. renter cohort to increase for the foreseeable future, especially middle-income renters, all while virtually no new supply is delivered. Virtus will continue to focus on Class B acquisition value-add opportunities, ground-up public private partnerships, and providing gap funding via preferred equity and mezzanine investments for quality properties where there’s a capital structure challenge.

Student Housing

Although we exited the student housing space some time ago near its peak levels and don’t presently own any student housing assets, we expect to re-enter that market during the Dance as distressed buying opportunities and high barrier development at high-demand schools become more attractive. Surprisingly, student housing collections have held up quite well in the short-term, mostly due to the parental guarantees on leases, and many students choosing to remain at school despite learning remotely. Pre-leasing is flat to up in the more institutional student housing portfolios, year-over-year, signaling that students and parents expect the 2020/2021 school year to be learning as usual. However, those portfolios are primarily comprised of housing at tier I public flagship universities and high-growth tier II universities, where demand will likely remain high for quality education at an attractive relative price. Those and other high ROI universities, like the Ivy League, Little Ivies, and the like, will have strong demand and perhaps even increased demand like what occurred during previous recessions.

This period of forced remote learning will likely be the death knell for lower quality schools or schools that don’t offer a compelling return on investment for students and their parents. Many will have to re-tool and offer a more robust remote learning program at a lower cost, or they need to focus on high demand specialized and/or vocational educational offerings. Even for the colleges and universities in this category that make it, demand for student housing at these universities will likely fall and may not recover. In summary, student housing at the universities offering a compelling ROI will remain in demand (new supply is still a concern at many of these, but that will likely abate in the intermediate term), but student housing at other colleges and universities to be more disrupted by lower cost distance learning will suffer.

As we stated last month, all of our property segments will experience moderate challenges during the short-term, but the intermediate and long-term will likely exhibit the same resilient demand we have seen for these property types during previous periods of distress, while also experiencing a decrease in the rate of new supply growth. We view the current and coming periods as an opportunity to again prove the resilience of the strategy while seizing upon the increased opportunity to buy quality assets at attractive bases from distressed owners.

Related: In a World of Low and Negative Interest Rates, What Is an Investor to Do?