Written by: Joseph Burns | iCapital

Hedge funds can play an important role in helping individuals achieve their investment objectives, providing access to differentiated trading strategies and a broader range of exposures than traditional long-only portfolios. At the same time, there is greater complexity associated with hedge funds in terms of their structures, investor eligibility, and fees and expenses.

With more investors seeking diversification in their portfolios, there is a compelling case for why advisors should better understand the unique characteristics of the asset class, as well as the fees charged by hedge fund managers.

STRUCTURE

Hedge funds are generally structured as limited partnerships. The manager of the fund is the general partner (GP) and the investors are limited partners (LPs). The GP invests the fund’s capital and manages the portfolio of investments, while the LPs are passive investors in the fund.

INVESTOR ELIGIBILITY

Importantly, investors must qualify to participate in hedge fund investments. Many funds require qualified purchaser status.1 However, hedge funds registered under the Investment Company Act of 1940 have become available to accredited investors and with minimum commitment levels, as low as $25,000.2

ACCESS

There are different ways to access and make an investment in a fund. Investors may seek direct access to a hedge fund, where they make an investment directly with the GP. For individual investors, the challenge with a direct investment lies in researching and choosing the right fund and being accepted as an LP. Unlike institutional investors, many individual investors require support in conducting investment and operational due diligence when assessing hedge funds. In addition, a direct investment with a hedge fund generally requires a higher minimum investment, usually starting at $1 million or more.

Investors can also access hedge funds through a feeder fund, which is an investment vehicle that provides access to a hedge fund, typically for a fee, usually at a lower investment minimum than is required for a direct investment in the underlying fund. Generally this allows investors with less capital to access an investment that would have otherwise been available only to large, institutional investors. For feeder funds, minimum investment levels start as low as $100,000. Individual investors may also gain access to due diligence through the feeder fund providing them with resources to assess the fund manager and investment strategy.

FEES & EXPENSES

Most hedge funds charge their investors an annual management fee, typically between 1–2%, charged on the net asset value (NAV) of the fund. Management fees are used to cover general business and overhead costs such as technology, employee salaries, and ongoing business management expenses.

In addition, GPs also charge performance fees, which traditionally represent 10–20% of any aggregate profits generated by the fund in a given year. Unlike other asset classes, where managers may only collect fees as a percentage of assets under management (AUM), hedge fund managers have an added incentive to deliver strong performance, rather than simply gathering assets.

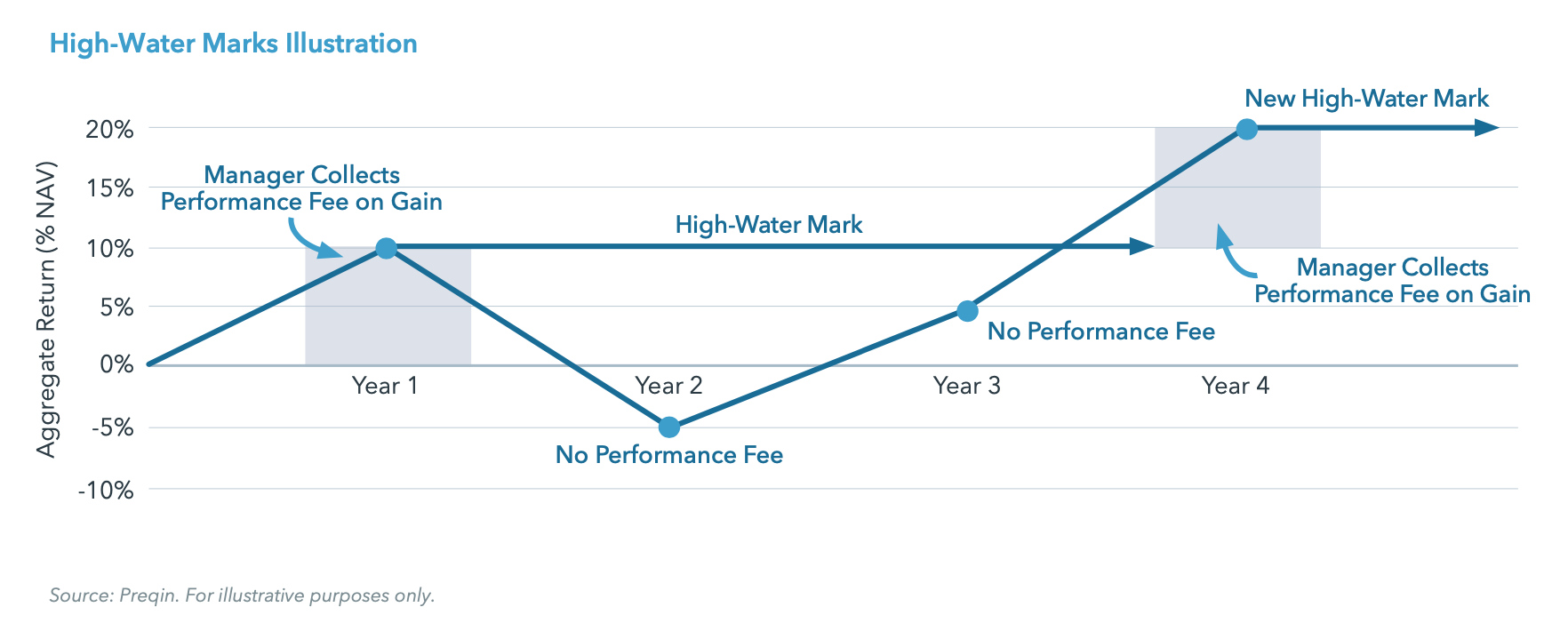

Most performance fees for hedge funds are subject to a high-water mark, which refers to the highest level of NAV the fund has reached. Funds with performance fees subject to a high-water mark are structured so that the fund can only charge a performance fee when they are generating returns above the previous high value of the fund. This ensures that performance fees are only paid on new profits in the fund, and that managers cannot earn a performance fee on profits that offset losses incurred previously.

Although less common, certain hedge funds may also include a hurdle rate, which is the minimum annual return that LPs are entitled to before the GP may begin receiving any performance fees. In the event a hedge fund includes both a high-water mark and hurdle rate, a fund manager would not be able to receive any performance fees unless the fund’s value exceeds the previous high-water mark and the returns are above the hurdle rate.

Fund expense fees, also known as operating expense or general expense fees, are incurred in the process of operating the fund and may include legal, audit, and administrative fees. These fees are charged to the fund on an annual basis, and typically range from 15 – 30 basis points of the fund’s AUM. In addition, some hedge funds may charge an additional layer of costs known as pass- through fees. Pass-through fees are often utilized by firms which employ multiple portfolio management teams who make investments on behalf of the fund. Pass-through fees are used to cover payouts to these portfolio management teams, who receive a portion of profits they generate for the fund, and other expenses incurred by the teams.

It is important to remember that hedge fund fees generally should be viewed in relation to the level and quality of management that is being provided. Hedge fund performance should be assessed net of fees. While hedge fund fees are generally declining,3 investors remain willing to pay for top-tier managers who offer consistently profitable strategies or unique risk/reward characteristics.

LIQUIDITY & RETURNS

Hedge funds are generally less liquid than exchange- traded funds (ETFs) and mutual funds, offering liquidity on a periodic basis, subject to certain limitations. Hedge funds typically offer investors the ability to withdraw their capital, or redeem their shares in the fund, on a monthly or quarterly basis, sometimes following an initial “lock-up period,” or a period of time from the date of the initial investment in which the investor’s capital cannot be redeemed. The length of the lock-up period is typically one year, but varies by fund.

Unlike private market funds, where distributions may be made throughout the life of the fund, hedge fund returns are typically realized when an investor redeems shares in the fund. Upon redemption, an investor would receive their initial investment amount, plus their share of any profits generated by the fund, net of any performance fees paid to the GP. If the hedge fund experienced a loss, the investor may receive less than their initial investment amount.

It’s important to note that investors must provide notice to the GP of their intent to redeem from the fund – usually 30 to 60 days in advance – and redemptions may be subject to a “gate,” or redemption limit, that constrains the amount of investor capital that can be withdrawn from the fund at any one time.

ALIGNMENT OF INTERESTS

One of the more compelling features of the hedge fund industry is the strong alignment of interests between GPs who manage funds and LPs who invest. A key driver of this alignment is the performance fee. Hedge fund managers are incentivized to deliver returns for their investors and have structured their fees in a way that enables them to participate in that upside. Additionally, hedge fund managers often have a substantial portion of their net worth invested in the fund, further aligning their interests with those of their LPs.

Hedge funds may be a valuable addition to a well- diversified portfolio, but they also carry risks and complexities that make them appropriate only for certain types of investors. Advisors and investors should learn as much as possible about the mechanics of hedge funds, the associated fee structures, and the potential benefits and risks before investing.

ENDNOTES

1. A qualified purchaser is generally defined as an individual with at least $5 million in investable assets or a company with at least $25 million of investable assets.

2. An accredited investor is generally defined as an individual with a net worth over $1 million, either individually or jointly with their spouse, excluding the value of their primary residence, or annual income exceeding $200,000, or $300,000 for joint income, for the last two years with expectation of earning the same or higher income in the current year.

3. Source: Preqin, 2022 Preqin Global Hedge Fund Report.

Related: Rare Short Duration High Yield Price Discount Creates Total Return Potential