Written by: Joseph Burns

A shifting relationship between stocks and bonds means the value of diversification is on a cyclical upswing that may last for years.

Nobel Prize winner Harry Markowitz once famously referred to diversification as “the only free lunch in finance.” His message was simple and timeless: By allocating capital across a mix of assets, clients can increase the probability of realizing their targeted return over time, with an acceptable level of portfolio volatility.

THE SHIFTING VALUE OF BROAD DIVERSIFICATION

One of the many challenges for investors is that the benefit of diversification does not really have a constant value. Multi-asset, multi-strategy hedge funds can play a pivotal role in achieving positive results for clients, though there have been periods when diversification could be structured without the benefit of alternative investments. The decade-plus period following the Global Financial Crisis is a case-in-point regarding how investors achieved sufficient diversification somewhat simplistically, through a basic “set it and forget it” allocation to a traditional portfolio of public equities and fixed income.

From March 2009 through year-end 2021, for example, $1 million invested in the S&P 500 Index grew to $8.4 million.1 During that period, fixed income, as measured by the Bloomberg U.S. Aggregate Bond Index, provided investors with an annualized return of 4% per year without ever experiencing a loss of more than 4%,2 so the return-generating and capital-protecting components of a portfolio were readily available through a traditional stock-bond allocation. But what about the final ingredient of sound portfolio construction: diversification? Did investors achieve high returns, capital protection, and portfolio diversification through a standard asset allocation?

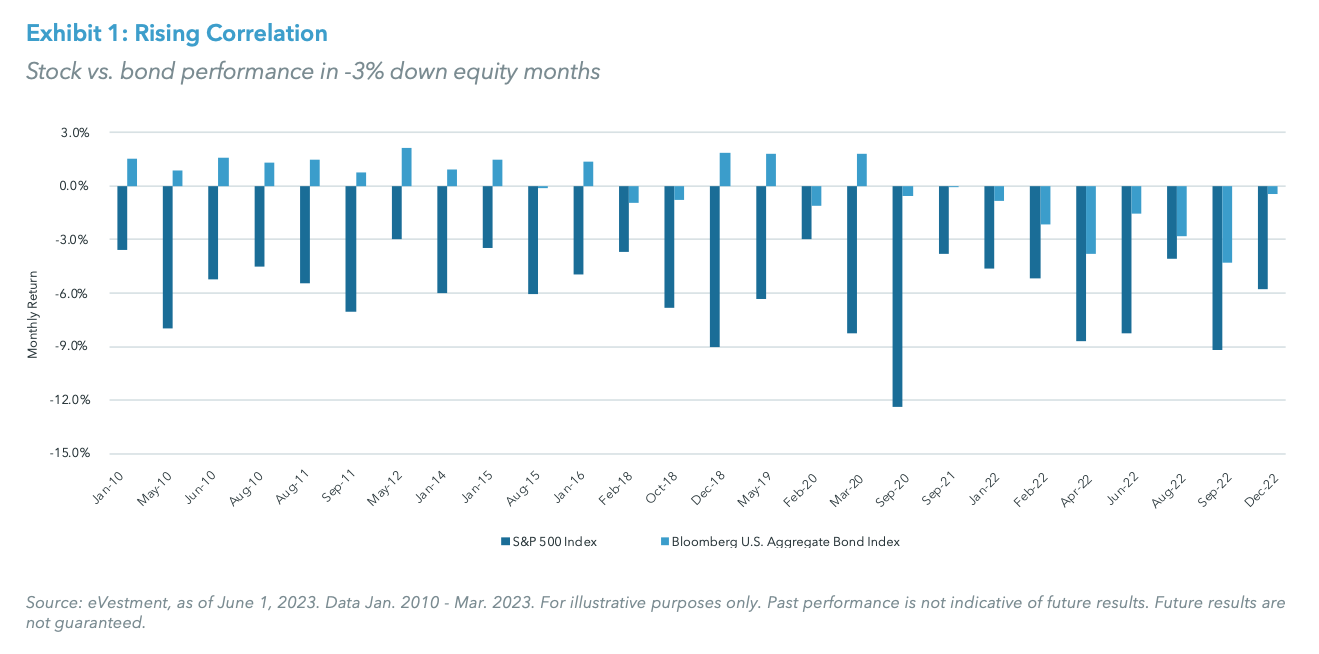

For the first half of the 2010s, the answer is a resounding yes. From 2010 through early 2015, every time the S&P 500 Index declined by at least 3%, the Bloomberg U.S. Aggregate Bond Index was positive. The average S&P performance for these “negative equity” months was approximately -5%, compared to an average gain of 1.3% for fixed income.3 When bond yields are anchored at zero, the main function of fixed income is a flight to quality diversifier whenever stocks decline. A strategy of loading up on risk assets and hedging out some of that risk by owning bonds was more than sufficient to deliver positive outcomes.

That relationship started to shift over the next five years. While fixed income still produced positive performance on average, the relationship was no longer as structurally sound, with fixed income falling nearly half the time that stocks declined.4

Since 2020, the correlation between stocks and bonds has experienced a paradigm shift. There have been 10 months over the past three years when the S&P 500 Index fell by 3% or more; and fixed income has fallen each and every time.5 What had been essentially “automatic diversification” for traditional asset-only investors throughout much of the 2010s has completed inverted, demanding new return sources and strategies to deliver the desired results for clients.

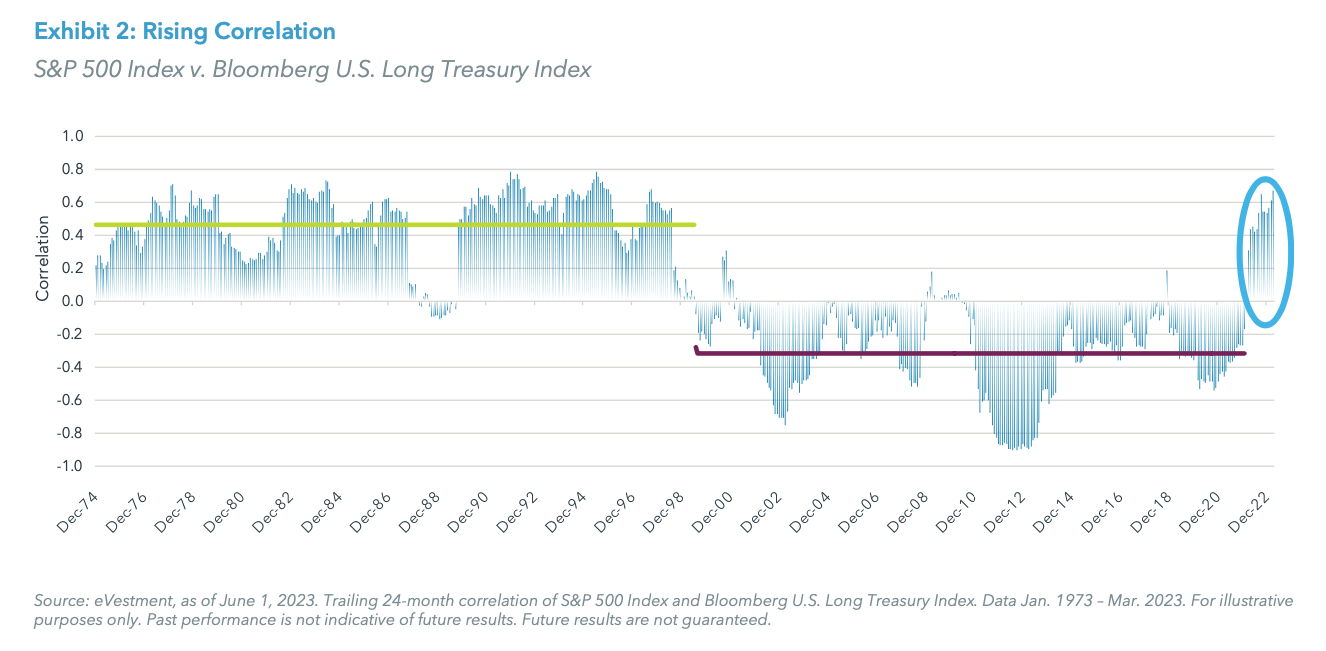

While it may be tempting to view this positive correlation through a lens of recency bias, reviewing this stock-bond relationship over an even longer period highlights how traditional assets have been positively correlated for significant periods of time historically, and that a false sense of security from stock/bond diversification may be dangerously misplaced. If the past three years are any indication, we may have already entered an environment when bonds will not be the automatic safeguard against declines in the stock market, as many have come to expect.

MULTI-STRATEGY PORTFOLIOS ARE BUILT FOR THIS ENVIRONMENT

If the relationship between stocks and bonds has indeed shifted, at a time when returns may be harder to come by with episodic spikes in multi-asset class volatility, how can investors avoid missing out on the diversification “free lunch” that helps drive performance while protecting against excess risk? Within hedge funds, the answer is clear: Diversified multi-strategy portfolios are purpose-built for this type of environment. Over the past few years, select funds have demonstrated an ability to generate attractive absolute returns, while protecting capital during market pullbacks. Periods such as the COVID-driven dislocation in early 2020 and the inflation-induced selloff in 2022 provide the most recent examples.

The value of diversification has clearly been on an upswing and, historically, these shifting asset class cycles often persist for long periods of time. Against this backdrop, the diversified multi-strategy model, with a record of delivering consistent returns independent of traditional equity and fixed income markets, has been proving its worth in client portfolios for years. Looking ahead, investing in established, successful multi-strategy funds can increase returns, reduce risk, and produce the desired outcomes for clients.

Related: A Non-Traditional Approach To Generating Yield

ENDNOTES

1. eVestment, as of June 1, 2023. Data Mar. 2009 - Dec. 2021.

2. Ibid.

3. eVestment, as of June 1, 2023. Data Jan. 2010 - Mar. 2023.

4. Ibid.

5. Ibid.