Written by: Gabor Gurbacs

Learn more about how bitcoin fits within an investment portfolio and the impact of an allocation to bitcoin. View the full presentation: The Investment Case for Bitcoin.

We often refer to bitcoin as “digital gold” because, like the metal, it is a potential store of value. To determine if bitcoin has value, it is important to start with an understanding of the two types of value:

- Intrinsic value exists because an economic good—such as equities, real estate and consumable commodities like corn and oil—produces cash flow or has overt utility.

- Monetary value exists despite an economic good not having intrinsic value or because it has value beyond its intrinsic value. Examples include gold and other precious metals, artwork and gemstones.

Adding Bitcoin to an Investment Portfolio

If bitcoin is increasingly used as an asset with monetary value, what role might it play within an investment portfolio?

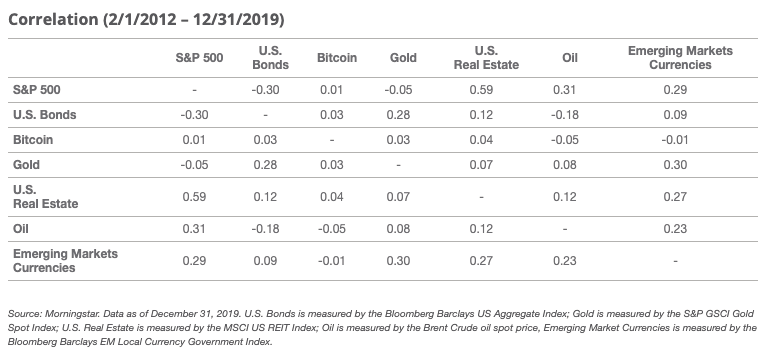

Bitcoin may potentially increase portfolio diversification because of its low correlation to traditional asset classes, including broad market equity indices, bonds and gold.

An allocation to bitcoin may also enhance the risk and return reward profile of institutional investment portfolios. As seen in the chart below, a small allocation to bitcoin significantly enhanced the cumulative return of a 60% equity and 40% bonds portfolio allocation mix while only minimally impacting its volatility.

Source: Morningstar. Data as of 12/31/2020.

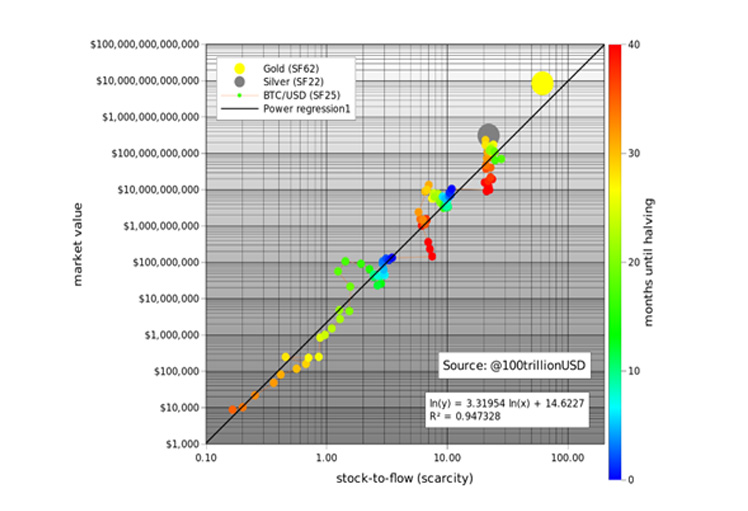

A look at the stock to flow ratio1 may also offer a view of bitcoin’s growth potential. The below stock to flow data suggests that bitcoin may have potential to grow, based on historical data and the scarcity characteristics of bitcoin, gold and silver.

Source: Medium, “Modeling Bitcoin’s Value with Scarcity,” March 22, 2019.

Furthermore, bitcoin has “halvings” programmed into it. A halving is defined as a 50% block reward cut to bitcoin production rate, and they occur roughly every four years. Given the scarcity induced by halvings, the price of bitcoin has historically increased following halvings.

Source: Cryptocompare. Data as of 12/31/2020.

Bitcoin Adoption Continues

Bitcoin transactions have crossed 400,000 permission-less transactions per day, exhibiting significant network value.2 When looking at off-chain adoption and the number of applications being built on Bitcoin, we see a natural evolution taking place.

Sidechains (such as Liquid by BlockStream) may be the next step in boosting Bitcoin adoption as they allow for scalability and customizations while retaining many of Bitcoin’s security properties. Built on top of the Bitcoin-blockchain, we believe the Lightning Network pushes the boundaries of Bitcoin payment capabilities with lower costs and faster speeds. Taking advantage of Bitcoin’s trust-minimized features, Microsoft is building a decentralized identity platform on the Bitcoin-blockchain.

Related: Assessing Bitcoin's Role in Portfolios, Store of Value Traits

Related: Believe It or Not, Bitcoin Hype Isn't Out of Control...Yet

DISCLOSURE:

1 The stock to flow ratio is defined as the amount of an asset that is held in reserves divided by the amount of that asset produced for a selected time period.

2 Source: Blockchain.info. Data as of 7/13/2019.