I was speaking with a friend from the United Arab Emirates (UAE) recently, and he had an interesting observation I want to share with you.

Some countries have climates and athletes that are better suited for the Winter Olympic Games, and others for the Summer Olympic Games. Every country on earth had to deal with Covid, though, whether they’re hot or cold, rich or poor.

Two Olympic Games have been held since the pandemic began, but according to my friend, Covid management has been the real test of a nation’s skills and strengths.

If that were the case, then the UAE is the gold winner, by a few estimations. My friend may be biased, but he’s very happy with how his country managed risk. I was in Dubai last October for the AIM Summit, and I was impressed with not just the reasonable Covid precautions but also the city’s infrastructure and futuristic architecture.

In February, the UAE topped Bloomberg’s “Covid Resilience Ranking.” The country, which relaxed entry requirements last month, had the most vaccine doses per 100 people and relatively low lockdown severity. Commercial flight capacity was down, but not nearly as much as others. If you’re curious, you can see the full list here.

Airlines Execs Seek End To Masks And Tests, Optimistic Of Summer Travel

Here in the U.S., executives of the biggest airlines are urging the Biden administration to bring an end to Covid-era travel restrictions. In an open letter, the CEOs of American, Delta, United, Southwest and others write that predeparture testing requirements and mask mandates “no longer make sense in the current public health context.”

Indeed, domestic and international traffic is up as passengers’ comfort level with taking a flight is at its highest level since the pandemic began, according to a survey by Evercore ISI. The firm’s sales survey also shows that bookings rose for a ninth straight week as of March 22, with leisure demand driving much of the growth.

International travel continues to lag domestic travel, but it’s also strengthening. Evercore ISI analysts Oscar Sloterbeck and James Walsh believe capacity is poised to increase next month (April) as we head into the busy summer travel season.

This belief is confirmed by Expedia, which expects an “amazing summer.” Expedia for Business president Ariane Gorin said this week that the online booking agency is seeing a rise in the number of U.S. travelers searching for European packages. “People are keen to spend the money that they have saved during the pandemic on travel,” she said.

Numbers don’t lie: Google searches in the U.S. for “flights to Europe” hit a pandemic high at the end of February. I expect to see the metric jump ever higher next month as families lock in their summer travel plans.

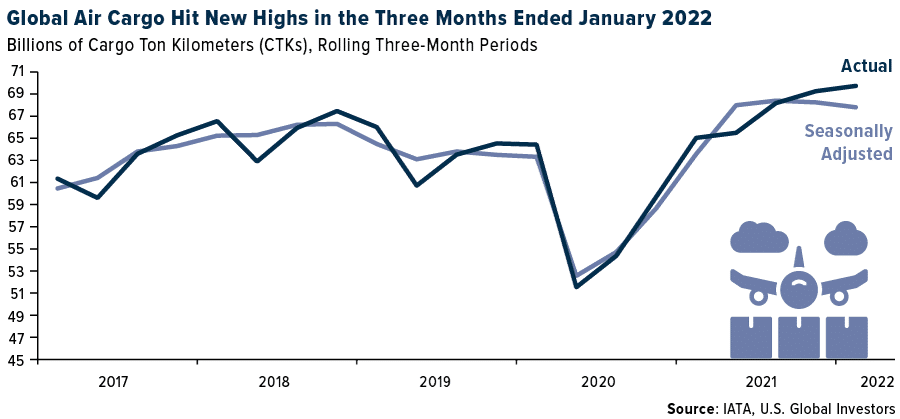

Air Cargo At All-Time Highs

Not to be outdone by air passenger volumes, air cargo capacity continues to trend upward. In the three months ended January 2022, industry-wide cargo ton kilometers (CTKs), a measure of cargo volume, rose 7.2% year-over-year to hit their highest levels on record, according to the International Air Transport Association (IATA). Seasonally adjusted, the value has cooled somewhat, but nevertheless this is an incredibly bullish reading for air cargo and demand in general. Looking at specific regions, Europe-North America increased 25.3% while Asia surged a remarkable 42.3%.

Alaska Airlines, one of our favorite names in the industry, is positioning itself to capitalize on this surge in demand. The carrier is reportedly converting two of its Boeing 737-800s into cargo jets on a bet that pandemic-era freight revenues remain high.

Of Oil And Bitcoin

Speaking of trade… Last week I shared a report by Credit Suisse’s Zoltan Pozsar wherein he predicted that China could act as a stopgap for plunging Russian commodities.

Sure enough, Bloomberg reports that Chinese refiners are buying cheap Russian oil “under the radar.” This is on top of Indian companies that are publicly signing deals to purchase crude from Russia or, in some cases, buying Russian crude for the first time in months. India’s Nayara Energy, a private refiner, just bought 1.8 million barrels of Urals crude, Russia’s benchmark oil, a week after Indian Oil Corp. imported 3 million barrels from the country.

Due to international sanctions, paying for the oil has been a challenge, but some Russian officials believe there’s a solution: Bitcoin. The country has proposed that buyers can trade in local currencies and gold, but this week it added the world’s most popular cryptocurrency to that list.

Interestingly, that wasn’t the only news story this week involving Bitcoin and oil. ExxonMobil, the largest U.S. oil and gas producer, announced that it’s been running a pilot program using excess natural gas to power Bitcoin mining, and that it plans to expand this activity to other locations including Alaska, Nigeria and Germany. Partially as a result of the news, Bitcoin touched $45,000 on Friday for the first time in about three weeks.

I believe Exxon’s plans are yet another indicator that investors may want to get their hands on some Bitcoin sooner rather than later. Remember, its supply is finite. Very soon, the 19 millionth Bitcoin will be mined, and there are over 8 billion people on earth. The math is very compelling.

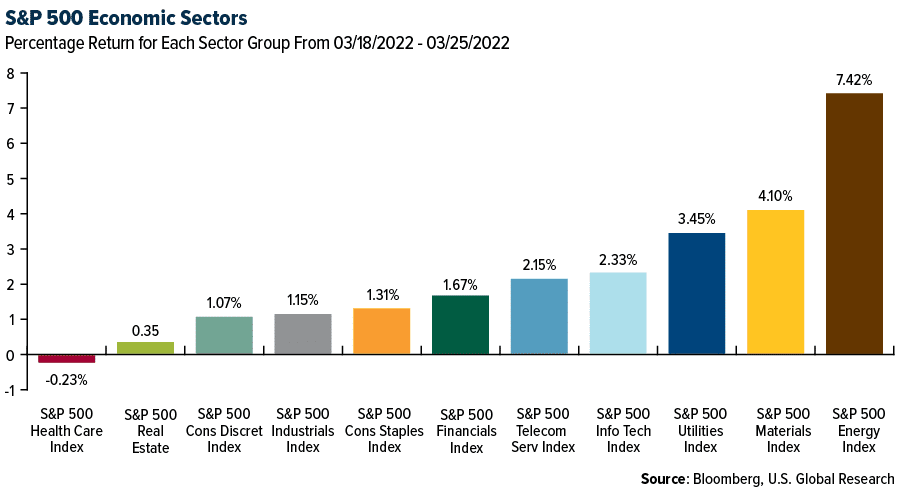

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average gained 0.31%. The S&P 500 Stock Index rose 1.79%, while the Nasdaq Composite rose 1.98%. The Russell 2000 small capitalization index lost 0.39% this week.

- The Hang Seng Composite lost 0.73% this week; while Taiwan was down 2.97% and the KOSPI fell 8.32%.

- The 10-year Treasury bond yield rose 34 basis points to 2.493%.

Airline Sector

Strengths

- The best performing airline stock for the week was GOL, up 11.5%. System net sales stepped up significantly to -15.4% versus 2019 for the week compared to -25.4% last week. Further, domestic leisure volumes and pricing are above 2019 levels, and for the first time since the pandemic, corporate bookings through smaller channels crossed above 2019 levels. Near term, the demand environment remains strong and appears to be exceeding supply for the first time in over two years.

- According to ISI, airline web traffic continues to build, and is at the highest level seen since tracking began early in the pandemic. March-to-date traffic was higher by 51% versus 2019, and the month of February was up 25% versus 2019, while January was flat versus 2019. For the week, U.S. airline industry web traffic was 128% higher year-to-year versus a 115% increase last week. Among Latin American carriers that ISI tracks, web traffic is up 61% year-to-year. Volaris (Mexico) web traffic is up 49% versus 2019, Copa (Panama) web traffic is up 82% versus 2019. European carrier web traffic is also up 268% year-to-year.

- Airline stocks hit a trough on March 7, which happened to be the day before oil prices hit a peak of $127.98. This trough was a -26% average decline from February 18, and since then, the group has recovered 23% on average. Fuel prices are about 14% higher than on February 18 and 17% higher than the end of January, but pricing power drives airline stocks.

Weaknesses

- The worst performing airline stock for the week was China Eastern, down 9.5%. European airline bookings continued to decline in the week, the second week in a row after Russia invaded Ukraine. Intra-Europe net sales fell by 21 points to -51% versus 2019 (and versus -30% in the prior week), with an 11% week-on-week decline and a big step-up in the 2019 base. International net sales were down by 11 points to -49% versus 2019, with a 2% decline this week. This led to a 14-point decrease in system-wide net sales for flights booked in Europe to -50% versus 2019. The fall was driven by lower ticket volumes, which reflect an ongoing negative impact of the Ukraine conflict on appetite to book travel.

- U.S. tourists are putting off visits to Europe, particularly Central and Eastern Europe, because of the Ukraine conflict, as per media reports. Bookings between the U.S. and Europe fell 13% week-on-week in the seven days after the invasion of Ukraine, according to Forward Keys data. Bookings collapsed for areas closest to the conflict, including Bulgaria, Poland and Hungary, as expected.

- Based on current scheduling data, second quarter 2022 planned growth for U.S. carriers is 90 basis points lower, to -6% versus 2019.U.S. to Atlantic region capacity is 70 basis points lower to -11% in the second quarter 2022, versus second quarter 2019. U.S. to Latin America region capacity is 180 basis points lower to -1% in the second quarter 2022 versus 2019 and U.S. to Pacific region capacity is 5% lower to -55%.

Opportunities

- The encouraging trend is that corporate bookings through smaller agencies are now above 2019 levels for the first time during the pandemic, up 1.0% versus 2019 (and versus -4.4% last week) while pricing is only -2.5% versus 2019. While large corporate bookings remain behind the channels, it continues to see improvements with domestic volumes -32.5% versus 2019 and pricing up 4.2% versus 2019. As office occupancy accelerates in the coming months, there may be stronger step-ups in large corporate channels.

- U.S. airlines’ trailing seven-day website visits improved this week by 12% versus 2019 for the week. This week, JetBlue’s trailing seven-day website visits jumped up 23% versus 2019 due to its “Big Spring Sale,” which was valid through March 17 and offered fares as low as $34 one way. Allegiant’s website visits also improved by 45% versus 2019 and compared to up 26% last week.

- Demand for travel services continues to rise, as the Evercore ISI Airline Survey strengthened for a ninth consecutive week, moving from 51.3 to 55.0. Leisure demand has driven much of the strength, and leisure bookings have returned to pre-Omicron levels. Recently, business activity has picked up a bit more contributing to recent gains. International activity which has steadily strengthened since mid-January, as restrictions ease and consumers have become more comfortable with booking international travel, rose from 40.0 to 42.5 this week.

Threats

- In the past three to four weeks, airline stocks have been whipsawed by crude’s spike to $130 per barrel followed by a collapse to $100-$110 per barrel and a confirmation by management teams of the strong pricing environment. With the way demand is trending, it could exceed supply for the first time in the pandemic, which is driving pricing power.

- Coronavirus case counts are starting to rise again due to yet another variant, BA.2. Thus far, Germany and the Netherlands appear most affected. BA.2 does not seem more severe than Omicron (BA.1) and there should be some protection for the millions who got BA.1 for some period; as a result, this could have an impact on reopening.

- Forward Keys’ data on bookings in the week, following the invasion noted countries in Eastern Europe, saw a 30-50% decrease, while most other European countries saw declines of 10-30%; Transatlantic travel booked from Europe and the U.S. fell 23% and 13%, respectively.

Emerging Markets

Strengths

- The best performing country in emerging Europe for the week was Turkey, gaining 1.5%. The best performing country in Asia this week was the Philippines, gaining 1.8%.

- The Russian ruble was the best performing currency in emerging Europe this week, gaining 3.0%. The Philippine peso was the best performing currency in Asia this week, gaining 0.27%.

- Preliminary March S&P Global Eurozone Manufacturing PMI was reported at 57.0, above the expected reading of 56.0. Service PMI surprised to the upside as well. It was reported at 54.8, above the expected reading of 54.3.

Weaknesses

- The worst performing country in emerging Europe for the week was Romania, losing 2.15%. The worst performing country in Asia this week was India, losing 1.3%.

- The Romanian leu was the worst performing currency in emerging Europe this week, losing 0.60%. The South Korean won was the worst performing currency in Asia this week, losing 0.95%.

- The Federal Reserve’s hawkish tone in the United States may push the dollar higher, putting downward pressure on emerging market currencies. The BBH Currency Strategy Team believes the dollar will continue to move higher.

Opportunities

- Earlier this month China announced 2.5 trillion-yuan tax cuts, worth roughly 2% of gross domestic product. The country has been using tax cuts over the past eight years to boost growth, according to Piper Sandler research. And this year the tax assistance is mainly to help support small businesses who are struggling.

- Poland proposed tax reforms that should raise disposable income. According to the Ministry of Finance, the annual cost of proposed tax changes should amount to 15 billion zloty and should be positive for around 13 million taxpayers in Poland. Raising disposable income should benefit retailers too.

- According to Bloomberg, the Central and Eastern European exchanges, including those in Poland, Hungary, the Czech Republic, Slovakia, Romania, and the Baltics, stabilized in the third week after Russia invaded Ukraine. Trading volume was close to 122 million shares and turnover reached 452 million euros, which represents last year’s norms. Investors will likely remain cautious and selective in the region, and when ceasefire takes place more trading most likely will follow. Poland could present a buying opportunity considering its much higher weight in the index following Russia’s removal.

Threats

- Russian President Vladimir Putin has made abundantly clear that human life is worth nothing to him unless it’s his own. With the Russian army not succeeding and the Ukrainian army now taking some cities back, Putin may soon be put in a tight corner. Hopefully he will not decide to use nuclear weapons against the Ukrainian resistance.

- Central banks in central emerging Europe (CEE) continue to hike rates in order to fight inflation. Hungary increased its rate to 6.15% in March, Poland 3.0%, and the Czech Republic most likely will hike to 5% next week. The decision will be made on March 31. The European Central Bank (ECB) this week said that eurozone inflation will be “higher for longer” than previously thought.

- The Moscow Stock Exchange started to trade 33 securities this week. Short selling was banned, and only local residents were able to transact. There is speculation that Russia may split the Moscow Stock Exchange into parts: domestic and foreign trading. Many foreign investors were not able to dispose Russian assets after Russia attacked Ukraine and it could take a while longer for access to be granted.

Energy & Natural Resources

Strengths

- The best performing commodity for the week was natural gas, up 14% on forecasts for colder weather in the Midwest and strong expectations of a shift in world demand away from Russian supplies. Oil surged for a third day as the war in Ukraine neared the one-month mark with no conclusion in sight. Brent topped $111 per barrel, up 14% since its close last Wednesday. The European Union will consider a Russian oil embargo this week, with U.S. President Joe Biden due in the region for NATO, Group of Seven and EU summits, Reuters reports. The Kremlin said any such ban would harm everyone.

- European steel prices surged back to a record as Brussels prepares to ban imports from Russia as part of additional sanctions, threatening to further tighten supply. Benchmark rates for hot-rolled coil in northern Europe jumped 10% to $1,583 a ton on Friday, according to weekly data from Kallanish Commodities Ltd. Prices for rebar also rose to a fresh all-time high.

- China placed its top steelmaking hub under lockdown to control a COVID outbreak, adding to supply uncertainties roiling the global industry and pushing up prices. Residents of Tangshan — a city in the northern province of Hebei — are not allowed to leave their buildings under temporary curbs announced Tuesday evening. The area has long played a pivotal role in the world’s biggest steel industry, churning out a sizable chunk of the country’s output.

Weaknesses

- The worst performing commodity for the week was lumber, down 15.67%. Marginal shifting, from do-it-yourself home improvement projects to travel and entertainment spending by consumers post covid lockdowns, has some wondering if that’s what is behind the recent fall in lumber prices. Lumber supplies are also expected to seasonally increase but demand has remained firm.

- U.S. and U.K. oil majors such as Shell Plc and BP Plc may be stuck with their Russian assets despite saying that they will leave the country to protest the invasion of Ukraine, said Total Energies SE CEO Patrick Pouyanne. “Everybody’s telling me that my Anglo-Saxon competitors are leaving,” Pouyanne said on RTL radio on Wednesday. “None of my competitors have left Russia and know how to leave Russia.” As reported by Bloomberg, both Shell and BP have said they will quit Russia altogether, but so far have not come up with concrete steps on how to achieve that.

- The global economy will not be able to avoid a recession without a resumption of Russian energy exports this year, according to a study by Federal Reserve Bank of Dallas economists. “If the bulk of Russian energy exports is off the market for the remainder of 2022, a global economic downturn seems unavoidable,” economists Lutz Kilian and Michael Plante wrote in an article posted by the Dallas Fed Tuesday. “This slowdown could be more protracted than that in 1991.”

Opportunities

- The global aluminum market may be headed for a crisis that could lift prices far above $4,000 per ton if trends persist. Consumption is outstripping supply, key stockpiles are sinking, and the war in Ukraine and its far-flung repercussions are making matters even worse. Stockpiles tracked by the LME have sunk to the lowest since 2007.

- Australia’s ban on alumina exports to Russia is heaping more pressure on aluminum giant United Co. Rusal International PJSC, reports Bloomberg and Mining.com, pushing up prices of the most widely used base metal. Aluminum jumped and Rusal’s shares dropped after Australian Prime Minister Scott Morrison announced the immediate ban on Sunday. Australia supplies almost 20% of Russia’s alumina — the key ingredient for producing aluminum — and its exports of aluminum ores, including bauxite, to the country have also been prohibited. While aluminum has not been targeted by sanctions, Rusal — which needs bauxite and alumina to feed its plants – faces disruption to its supply chains as Russia becomes isolated from the world economy.

Energy & Natural Resources

Strengths

- The best performing commodity for the week was natural gas, up 14% on forecasts for colder weather in the Midwest and strong expectations of a shift in world demand away from Russian supplies. Oil surged for a third day as the war in Ukraine neared the one-month mark with no conclusion in sight. Brent topped $111 per barrel, up 14% since its close last Wednesday. The European Union will consider a Russian oil embargo this week, with U.S. President Joe Biden due in the region for NATO, Group of Seven and EU summits, Reuters reports. The Kremlin said any such ban would harm everyone.

- European steel prices surged back to a record as Brussels prepares to ban imports from Russia as part of additional sanctions, threatening to further tighten supply. Benchmark rates for hot-rolled coil in northern Europe jumped 10% to $1,583 a ton on Friday, according to weekly data from Kallanish Commodities Ltd. Prices for rebar also rose to a fresh all-time high.

- China placed its top steelmaking hub under lockdown to control a COVID outbreak, adding to supply uncertainties roiling the global industry and pushing up prices. Residents of Tangshan — a city in the northern province of Hebei — are not allowed to leave their buildings under temporary curbs announced Tuesday evening. The area has long played a pivotal role in the world’s biggest steel industry, churning out a sizable chunk of the country’s output.

Weaknesses

- The worst performing commodity for the week was lumber, down 15.67%. Marginal shifting, from do-it-yourself home improvement projects to travel and entertainment spending by consumers post covid lockdowns, has some wondering if that’s what is behind the recent fall in lumber prices. Lumber supplies are also expected to seasonally increase but demand has remained firm.

- U.S. and U.K. oil majors such as Shell Plc and BP Plc may be stuck with their Russian assets despite saying that they will leave the country to protest the invasion of Ukraine, said Total Energies SE CEO Patrick Pouyanne. “Everybody’s telling me that my Anglo-Saxon competitors are leaving,” Pouyanne said on RTL radio on Wednesday. “None of my competitors have left Russia and know how to leave Russia.” As reported by Bloomberg, both Shell and BP have said they will quit Russia altogether, but so far have not come up with concrete steps on how to achieve that.

- The global economy will not be able to avoid a recession without a resumption of Russian energy exports this year, according to a study by Federal Reserve Bank of Dallas economists. “If the bulk of Russian energy exports is off the market for the remainder of 2022, a global economic downturn seems unavoidable,” economists Lutz Kilian and Michael Plante wrote in an article posted by the Dallas Fed Tuesday. “This slowdown could be more protracted than that in 1991.”

Opportunities

- The global aluminum market may be headed for a crisis that could lift prices far above $4,000 per ton if trends persist. Consumption is outstripping supply, key stockpiles are sinking, and the war in Ukraine and its far-flung repercussions are making matters even worse. Stockpiles tracked by the LME have sunk to the lowest since 2007.

- Australia’s ban on alumina exports to Russia is heaping more pressure on aluminum giant United Co. Rusal International PJSC, reports Bloomberg and Mining.com, pushing up prices of the most widely used base metal. Aluminum jumped and Rusal’s shares dropped after Australian Prime Minister Scott Morrison announced the immediate ban on Sunday. Australia supplies almost 20% of Russia’s alumina — the key ingredient for producing aluminum — and its exports of aluminum ores, including bauxite, to the country have also been prohibited. While aluminum has not been targeted by sanctions, Rusal — which needs bauxite and alumina to feed its plants – faces disruption to its supply chains as Russia becomes isolated from the world economy.

- Even prior to Russia/Ukraine war, LNG was already seen as the best-positioned fossil fuel for the energy transition given its low carbon profile and carbon capture potential. And the Russia/Ukraine crisis has only served to turbocharge the LNG story, where Europe is set to turn to LNG to replace piped natural gas from Russia. This has led to a recent pickup in LNG sale and purchase agreements.

Threats

- The decision by the world’s largest providers of oil services to stop taking on new business in Russia will not affect the nation’s current crude output but is a threat to its longer-term production growth. The International Energy Agency predicts Russia’s oil output will slump by a quarter next month, while Deputy Prime Minister Alexander Novak said output will remain steady.

- U.S. steel prices have inflected, following a five-month period of price declines since September highs last year, with spot now at $1,300 per ton. Much of this inflection has been driven by the impacts of the Russia/Ukraine conflict, with trade flow disruptions across the entire global steel supply chain. There remains significant uncertainty around the longer-term outlook for supply, demand and therefore pricing.

- Stop the flow of oil from Russia and large parts of Germany would grind to a halt, writes Bloomberg. While neighboring Poland is weaning itself off the Kremlin’s crude, Europe’s industrial powerhouse remains so dependent that it would struggle to support the ban on Russian fuel supplies that is under debate in the European Union this week, writes Bloomberg oil strategist Julian Lee. This dependence at the heart of the continent limits the economic punishment the EU can mete out to Vladimir Putin for his invasion of Ukraine.

Domestic Economy & Equities

Strengths

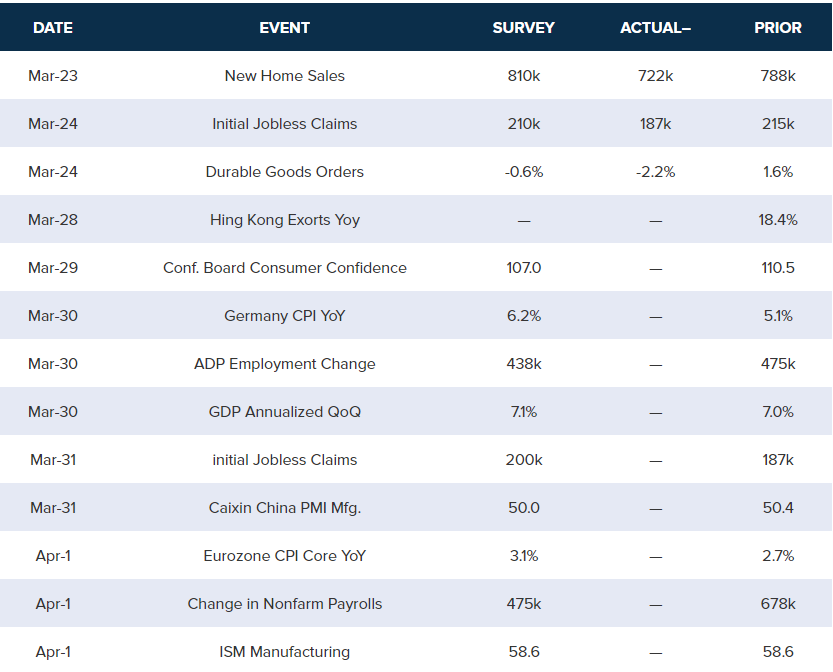

- The job market continues to improve. Initial jobless claims declined to 187,000 and below the expected 210,000. Continuous claims dropped to 1,350,000 below expected 1,400,000.

- Preliminary March S&P Global Manufacturing PMI was reported at 58.5, above the expected reading of 56.6 and above February’s 57.3. Service PMI improved as well. It was reported at 58.9, above the expected reading of 56.0 and above February’s 56.5.

- Coterra Energy, an oil and gas company, was the best performing S&P 500 stock for the week, gaining 16.34%. The company is poised to benefit from the deal between Europe and the U.S. that will allow for more exports of LNG to Europe to help replace Russian gas.

Weaknesses

- February new-home sales came in at a 772,000, slower than consensus for 810,000 and below January’s downwardly revised 788,000 level. In percentage terms, home sales declined by 2.0% on a month-over-month basis and 6.2% year-over-year. Mortgage rates continue to increase.

- February durable goods orders missed. February headline durable goods orders fell 2.2% month-over-month, down from January’s 1.6% growth and missing estimates for a 0.5% decline. The latest release broke four straight monthly gains, and it was the biggest monthly decline since April 20.

- Pool Corporation, a swimming pool distributor, was the worst performing S&P 500 stock for the week, losing 11.79%. Shares lost on data released that new home sales declined on a month-over-month and year-over-year basis.

Opportunities

- U.S. President Joe Biden departed Wednesday on a high-stake presidential trip to Europe for a meeting with NATO members. He will visit Brussels and Poland to show unity with Europe. More sanctions will likely be announced against Russia. Any sign of ceasefire in Ukraine will be welcomed by citizens and financial markets.

- The employment rate is likely to continue its decline. Bloomberg economists predict the rate to drop to 3.7% in March from 3.8% in February. Data will be released on April 1.

- FactSet reported that the Street is looking for another good month of job gains with nonfarm payrolls expected to increase by 450,000 following a 678,000 jump in February. Change in nonfarm payrolls will be released next Friday.

Threats

- The Federal Reserve indicated that rates may hike faster than previously expected. Trades now bet on a 50 basis points hike in May and June.

- A global recession is unavoidable without a resumption of Russian energy exports this year, according to Dallas Fed economists. This slowdown could be more protracted than in 1991, when a recession was triggered by Iraq’s invasion of Kuwait the year prior. Some nations are exploring the use of trade credit for Russian oil, which may help ease the hit.

- Brent may hit $150 per barrel this year as supply shocks coincide with resilient travel demand, according to veteran trader Doug King. There are few options to pump more, and there’s little sign consumption is under threat, said King, whose Merchant Commodity Fund returned 28% in January and February.

Blockchain And Digital Currencies

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was All Best Web 3, rising 1,918%.

- Meta Platforms Inc. filed eight new trademark applications for its logo, reports Bloomberg, signaling plans to expand into crypto and virtual products and services, trademark attorney Michael Kondoudis said Wednesday. The applications cover blockchain software, virtual currency exchanges, financial and currency trading, and digital, crypto, and virtual currencies, he explained further.

- U.S. full-service investment bank Cowen announced on Wednesday that it has launched a dedicated digital asset division, becoming the latest Wall Street bank to enter the emerging cryptocurrency space, writes Investopedia. The new unit, named Cowen Digital, will allow the bank’s institutional investors to trade established cryptocurrencies, and provide a custody solution to store digital assets through Standard Custody & Trust Co.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was Web 3 Development, down 99.70%.

- Thailand’s securities regulator announced Wednesday that it is barring the use of cryptocurrencies for payment of goods and services. The ruling, effective April 1, does not ban investment in cryptocurrencies, which has become increasingly popular in the past year after being promoted by local exchanges, writes Bloomberg. The SEC said it was taking action in order to protect the stability of the country’s financial and monetary systems from threats including money laundering and other cybercrimes.

- Bitcoin developers don’t need to help digital asset owners recover lost cryptocurrency, an English judge said, in a decision that could help carve out new law on crypto and blockchain technology. Software developers who control digital asset networks do not owe any legal duties to those who store or trade crypto held on the networks, Judge Sarah Falk ruled on Friday, as reported by Bloomberg.

Opportunities

- Several central banks and the Bank of International Settlements have developed prototypes for a common digital currencies platform that has the potential to make cross-border payments more efficient, writes Bloomberg. Codenamed “Project Dunbar” the development also proves that financial institutions could use central bank digital currencies to transact directly with one another, reducing intermediaries and cutting cost and time.

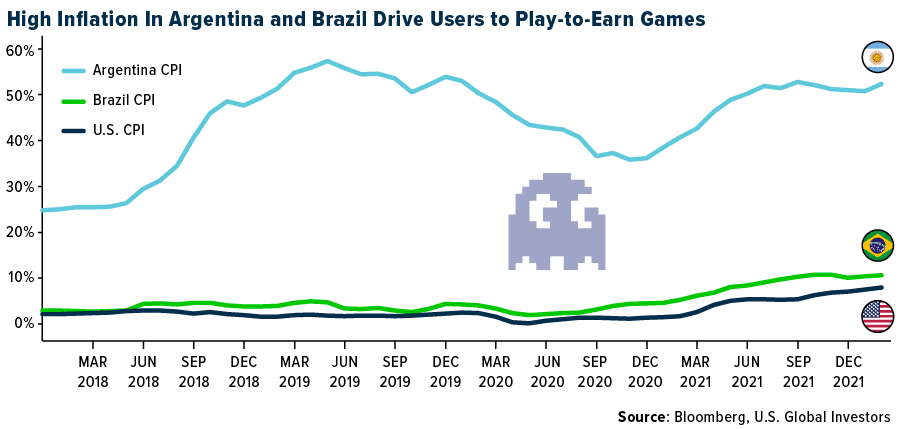

- Argentina has become the top place in Latin America for “play-to-earn” crypto games, as inflation running at a 10-month high erodes the value of local shares, reports Bloomberg. Argentina is the fifth country in the world when it comes to playing games for income and Brazil became the seventh-most popular place for these games. Both countries are grappling with double-digit inflation, trailing only Venezuela in Latin America.

- Russia has hinted that it may accept payment for oil in Bitcoin, sending the digital asset’s price above the 100-day moving average resistance. At a news conference Pavel Zavalny, the head of Russia’s State Duma Committee on Energy, said the government would be open to more flexible options on paying for its oil and gas from “friendly” nations, writes Bloomberg.

Threats

- The central bank of Ireland has warned consumers about the risk of “misleading” ads promoting crypto investments, particularly ones by influencers on social media, according to CoinDesk. The bank emphasized that crypto assets are highly risky and speculative, and that people need to be alert to the risk of misleading advertisements, particularly on social media, where influencers are being paid to advertise crypto assets. The warning comes as part of a Europe-wide campaign by financial regulators surrounding the risk in crypto investing.

- A hacker has stolen $1.8 million worth of crypto and NFTs from DeFiance Capital founder, proving yet again that even the most experienced crypto enthusiasts are not immune to cyberattacks, writes CryptoSlate. Arthur Cheong took to Twitter with the issue saying, “The only thing I can say to the hacker is: you messed with the wrong person.”

- South Korea is stepping up its crypto regulation with the Financial Action Task Force’s (FATF) Travel Rule. The rule requires crypto companies to collect and share customer information of users sending or receiving crypto. The cryptocurrency and DeFi sector in South Korea face headwinds in the coming weeks as the long-reported FATF becomes effective today, writes Cryptopolitan.

Gold Market

This week going into the close, gold futures were at $1,959.90, up $26.00 per ounce, or 1.34%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 3.23%. The S&P/TSX Venture Index came in up 3.79%. The U.S. Trade-Weighted Dollar rose 0.59%.

Strengths

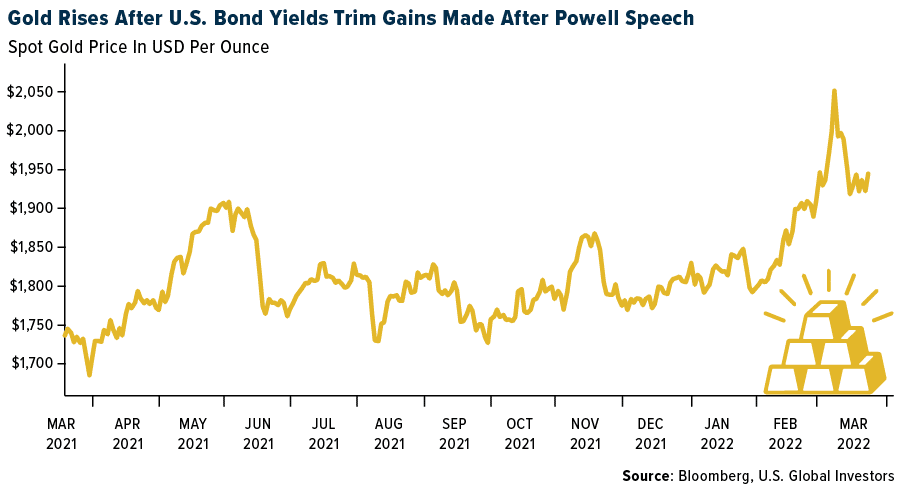

- The best performing precious metal for the week was silver, up 2.10% on the strong gold move. Gold advanced this week as bond yields eased after gaining on growing calls from Federal Reserve officials to raise interest rates faster. The yellow metal rose as much as 1.4% after dropping Tuesday when benchmark Treasury yields climbed to their highest since May 2019. Global bond markets have suffered as central banks, including the Fed, look to tighten policy, putting pressure on non-interest-bearing gold.

- GoGold Resources announced strong drilling results at its Mololoa deposit within Los Ricos North this week. “Mololoa continues to contribute strong results with high grade intercepts in addition to wider intercepts of potentially bulk mineable material,” said Brad Langille, President and CEO. “We believe these results will contribute to our goal of aggressively expanding our mineral resources at Los Ricos in 2022.”

- Gold producers are claiming a new defense against the challenge from cryptocurrencies: the metal is better for the climate. Alberto Calderon, chief executive officer of AngloGold Ashanti Ltd., made the point in a speech in Melbourne on Tuesday that mining for gold — which is being challenged by cryptocurrencies as a global store of value — is less carbon intensive than its digital rival. He also reckons the precious metal makes a bigger contribution to society. The listed global gold sector emits 78 million tons of carbon dioxide equivalent a year, Calderon said. That compares with 114 million tons for Bitcoin alone, before you add the cohort of rival tokens.

Weaknesses

- The worst performing precious metal for the week was palladium, down 6.82% as hedge funds continue to cut their net long positions. Northam Platinum released a trading statement guiding to first half 2022 headline earnings per share increasing 55-65% year-over-year to R9.32-9.92, and missing consensus headline earnings per share (HEPS) of R24.77. The miss appears to be primarily driven by a combination of lower-than-forecast sales volumes and higher-than-forecast unit cost inflation, translating into a 41% miss on EBITDA at R6.4bn, which reflects a 44% EBITDA margin versus consensus of 55%.

- Gold exchange-traded funds (ETFs) are one of this year’s hottest investments, with war, inflation and stock-market volatility sending people scrambling for safe havens. But those buying physical gold ETFs may face an unexpected tax burden, explains Bloomberg. Funds that invest in precious metals like gold and silver are treated like collectibles for U.S. tax purposes, meaning long-term capital gains from those funds will be taxed at a top rate of 28%, compared with a maximum rate of 20% for stocks.

- Zimbabwe’s biggest miner of rough diamonds sees Russia’s invasion of Ukraine triggering far-reaching consequences for the global gem industry, reports Bloomberg, and lifting demand for its own stones. Russia’s Alrosa is the world’s biggest diamond producer by volume at 30% and the slightest disruption to its ability to supply distorts the market, according to Zimbabwe Consolidated Diamond Co. Chief Executive Officer Mark Mabhudhu. “It may end up creating the supply gap that may drive demand for our product, as well as that of other players,” he said in an interview Monday. “However, we don’t wish for the worst case, but if it happens, we will be able to sell our production.” Both Signet and Tiffany announced they would stop buying Russian diamonds for their stores.

Opportunities

- Nano One Materials Corp. updated the market on the growing demand for localized and diversified battery supply chain in North America, Europe and India where materials can be sourced domestically. Lithium iron phosphate (LFP) batteries could serve that purpose as there is no nickel or cobalt needed to power these battery cells. LFP is also the safest, longest lasting and most affordable lithium-ion battery making them ideal for mass market applications. The recent additions of Mr Denis Geoffroy as commercialization lead and Dr. Yuan Gao as cathode technology advisor, brought decades of LFP experience to Nano One and its shareholders.

- Barrick Gold has reached an agreement-in-principle with the governments of Pakistan and Balochistan to bring back the Reko Diq copper-gold project into the picture. Under the proposed new agreement to restart the project, Reko Diq will be held 50% by Barrick, as the operator, and 50% by Pakistan stakeholders. Reko Diq is one of the largest, undeveloped copper-gold projects in the world. Development activities were suspended in 2011. There is a big prize at Reko Diq and this serves as a first step on the path to bring back this large copper-gold project into the picture, but there are several de-risking events that need to happen.

- Barrick Gold announced today that it has entered into a purchase and sale agreement to which Barrick agreed to sell, and the Dealer agreed to purchase, 8,831,250 common shares of Skeena Resources Ltd. for resale on a bought deal basis. The gross consideration for the common shares consists of cash in the aggregate amount of C$132,468,750.

Threats

- UBS initiates coverage of Gold Fields with a Sell rating and R210/share price target. The bank views Gold Fields as the quality play in the South Africa-listed gold space and believes its counter-cyclical investment approach has secured an attractive medium-term environment for the group with near-term earnings momentum remaining positive. However, given Gold Fields’ recent re-rating, UBS finds the company’s average free cash flow (FCF) yield of 9% over the next five years uncompelling in the context of its short-life international assets of 10 years. While management’s strong track record of resource conversion bodes well for further life extensions, UBS believes this requires higher capital spend, which will weigh on the group’s medium-term cash generation potential.

- UBS initiates coverage of AngloGold with a Neutral rating and R400 share price target. Falling production, rising unit costs, ongoing cash lockups and project delays have weighed on AngloGold’s share price, in the bank’s view, with it materially underperforming its major SA listed peer Gold Fields by 65% over the past 12 months on a total return basis. While UBS is not overly confident of a material turnaround, its analysts believe the expected ramp-up at Obuasi coupled with incremental improvements at some of its other operations (Tropicana, Geita, Siguiri, Iduapriem, Serra Grande and AGA) and improved cash conversion could provide some easy near-term wins.

- Through the first quarter, fuel consumption has been an area of emphasis for investors given the surge in energy prices this year. Producers have been faced with margin compression as energy costs outpace the stronger gold price, with fuel (primarily in the form of diesel) comprising 55% of total mine-site energy requirements. Given the rapid increase in energy prices, there is the potential for cost guidance to come under review should inflation pressures continue to persist. This comes despite budgeted considerations for gold producers with average AISC guidance increase of $100/ounce year to year vs 2021 costs. Based on average fuel consumption, there is an impact of $35/ounce Au solely attributed to higher energy prices to date; this represents 35% of the total budgeted AISC increase (which includes capital stripping programs and mine sequencing) before consideration of additional inflationary elements related to labor, power, and consumables.

Related: Remote And Hybrid Work Is Boosting Commercial Air Travel