Written by: Sebastien Bischeri

What are the new fundamentals for crude oil to look at this week? Could Asian demand be slowed down by Saudi Arabia raising its prices?

Crude oil prices soared earlier this week after Saudi Arabia said on Sunday it would raise crude oil prices for most regions except the United States. Just days after opening the floodgates a little wider (as announced last week following an OPEC+ meeting), Saudi Arabia wasted no time in raising its official selling price for Asia, its main market. It is worth noting that the country is one of the few OPEC members that has spare oil capacity. Thus, this decision to raise prices happens just when demand, especially in Asia, is increasing.

In the prediction contest, Goldman Sachs raised its forecast for the price of a barrel of Brent to $135 by the end of the year.

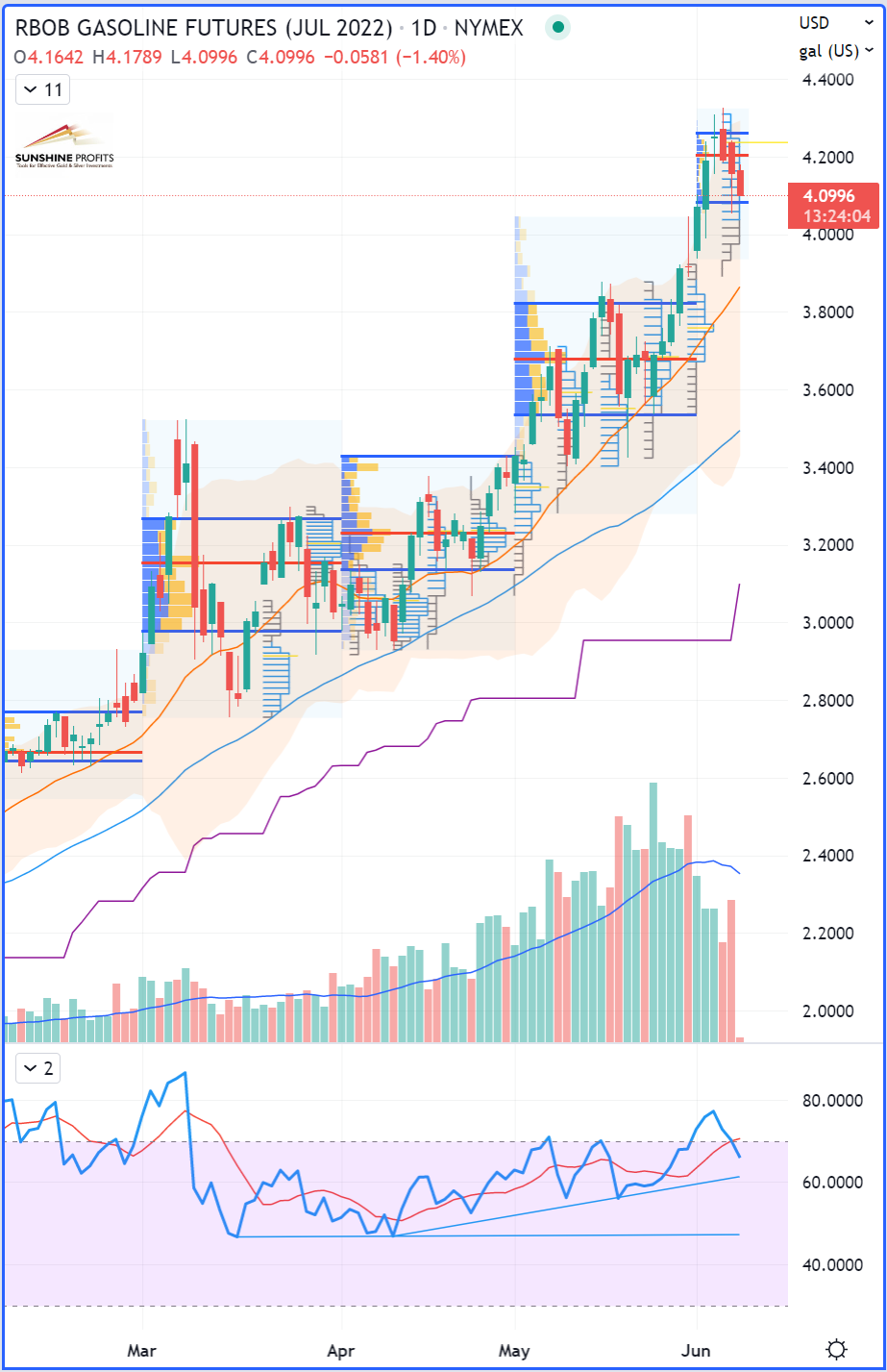

Looking at the impact of oil prices on gasoline, we are also starting to see changes in consumer behavior. As we head into the summer, people are likely going to think twice before making long trips by car during their vacation.

As a result, the “crack spread” is clearly narrowing, as you can see in the third following chart.

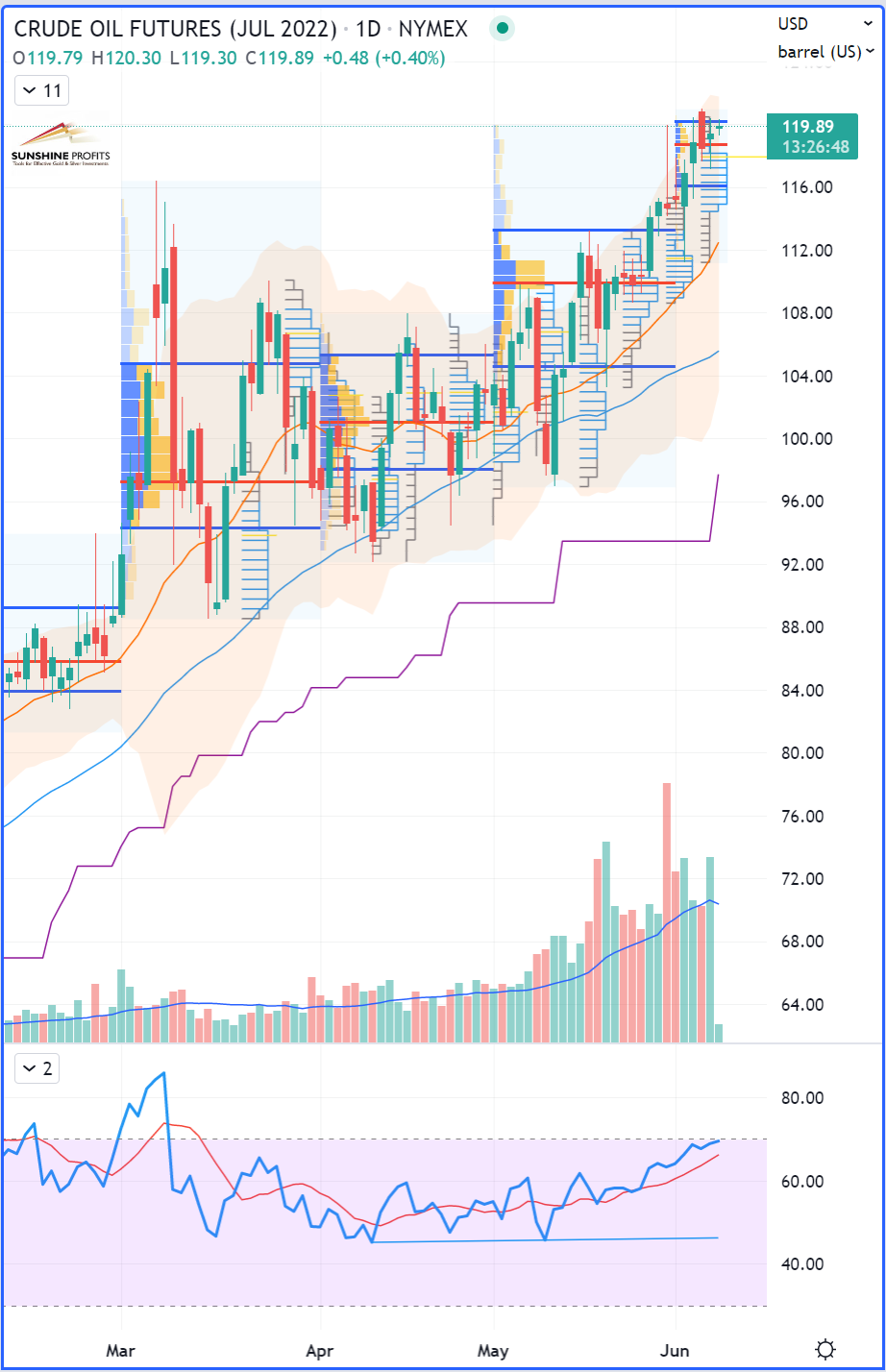

WTI Crude Oil (CLN22) Futures (July contract, daily chart)

RBOB Gasoline (RBN22) Futures (July contract, daily chart)

42 x RBOB Gasoline (RBN22) - WTI Crude Oil (CLN22) “Crack Spread” Futures (July contracts, daily chart)

Question: Is RBOB gasoline taking the lead now to pull crude oil prices back lower with it, or will the RB-CL spread find a rebounding floor around the $50 price mark, acting as support?

Related: High Fuel Costs Are A Cautionary Tale Against Extreme Climate Policies