Written by: Sebastien Bischeri

Recently, oil prices hit their highest levels in 7 years. Despite this, we are witnessing a surprising increase in US inventories. Why is that?

Energy Market Updates

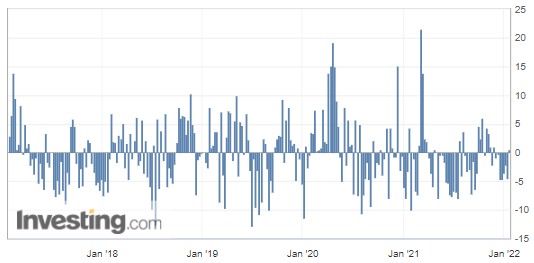

Crude oil retreated this morning in the pre-US trading session, after another volatile day on Thursday. It was followed by the weekly release of US inventory figures that surprised the market with an increase in stocks published by the Energy Information Administration (EIA). Meanwhile, market participants were expecting a drop close to 1 million barrels, which implies a slowdown in demand.

This imbalance has led to soaring prices for petroleum products and distillates, which will add pressure on households and businesses already struggling with higher levels of inflation. Also, as I mentioned in more detail on Wednesday, there are also geopolitical tensions in various regions carrying some uncertainty, which is an additional turbine to propel oil prices.

(Source: Investing.com)

RBOB Gasoline (RBH22) Futures (March contract, daily chart)

WTI Crude Oil (CLH22) Futures (March contract, daily chart)

Do you think that black gold will be worth three figures ($100) anytime soon? In the first quarter of 2022, maybe?

Related: Oil Markets More Animated by Geopolitics, Supply, and Demand

The views and opinions expressed in this article are those of the contributor, and do not represent the views of IRIS Media Works and Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.