Written by: Thomas Van Spankeren, CFA, CFP® | RISE Investments

- There are multiple ways to own the S&P 500 index including the popular Market Capitalization Weighted (“Market-Cap”) S&P 500 index strategy and the lesser known Equal Weighted (“Equal-Weight”) S&P 500 index strategy

- The Market-Cap S&P 500 index has outperformed more recently however the Equal-Weight S&P 500 index has outperformed over multiple market cycles

- The Equal-Weighted S&P 500 strategy is an effective way to bolster diversification and take advantage of broader market opportunities

Background: Market Cap vs. Equal Weight S&P 500 Index

Introduction

The S&P 500 is arguably the most well-known equity index comprising of the largest 500 corporations in the United States. The most common composition of the S&P 500 is the Market-Cap S&P 500 index which weights each constituent relative to the stock’s market capitalization. Alternatively, the Equal-Weight S&P 500 index assigns an equal weight to each of the 500 constituents.

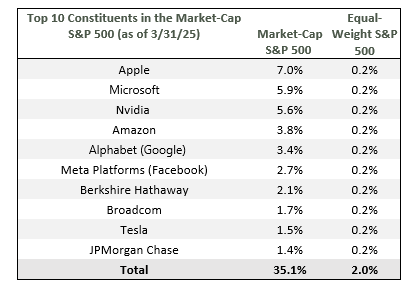

To visualize the difference between the two indices, here are the top 10 constituents of the Market-Cap S&P 500 and those same companies’ weightings in the Equal-Weight S&P 500 index.

Long Term Performance

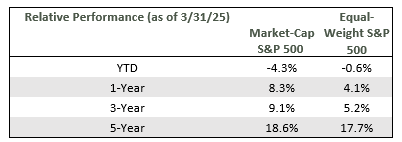

The Market-Cap S&P 500 has outperformed the Equal-Weight S&P 500 index over the past 1,3 and 5 year time periods as performance of Mega-Technology stocks powered the Market-Cap S&P 500 index relative to the Equal-Weight S&P 500 index. Most recently, the Equal-Weight S&P 500 index has outperformed the Market-Cap S&P 500 index.

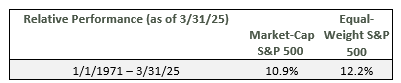

However, one may be surprised that since the Equal-Weight S&P 500 index has meaningfully outperformed the Market-Cap S&P 500 index since it’s inception in 1971.

Long-term outperformance of the Equal-Weight S&P 500 index is primarily driven by greater exposure to smaller companies versus larger companies. The Market-Cap S&P 500 index is overweight the largest companies and is underweight the smaller companies. Financial studies have showed that smaller sized companies outperform larger sized companies over multiple market cycles[1].

Benefits of Equal-Weight S&P 500 Index

We observe three main benefits of the Equal-Weight S&P 500 index at the current market juncture.

Disciplined Re-balancing

The Equal-Weight S&P 500 index re-balances on a quarterly basis by trimming the positions that have outperformed in the quarter and adding to the positions that have underperformed in the quarter. This mechanism reduces exposure to higher valued larger sized companies and bolsters exposure to cheaper smaller sized companies. For instance, the weighted average market cap of the Market-Cap S&P 500 Index is $313.2 billion whereas the weighted average market cap of the Equal-Weight S&P 500 Index is $42.8 billion.

Additionally, this disciplined process prevents concentration risk as holdings are re-weighted to the 0.2% target weighting.

Diversification Benefits

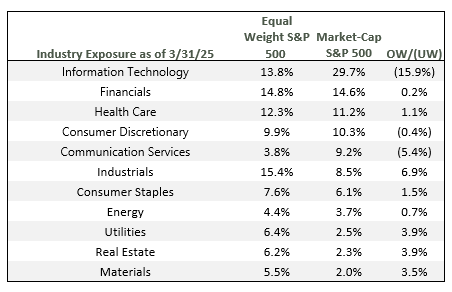

Exposure to the Equal-Weight S&P 500 index not only significantly reduces concentration risk but boosts exposure to a broader array of industries. For instance, the difference in industry exposure of the Market-Cap and the Equal-Weight S&P 500 indices is noteworthy.

The Information Technology sector is the largest weighting in the Market-Cap S&P 500 index at 29.7% of the index. One may consider the Market-Cap S&P 500 index’s technology exposure to be over 40% as innovative companies such as Google (3.4%), Amazon (3.8%), Facebook (2.7%) and Tesla (1.5%) are not classified in the Information Technology sector.

The Equal-Weight S&P 500 index increases exposure to cyclical industries such as industrial stocks while offering far more reasonable overall sector exposure.

Attractive Relative Valuations

The valuation of the Equal-Weight S&P 500 index offers more comparative bargains than the Market-Cap S&P 500 index.

While valuation is not an immediate near-term timing metric, starting valuations are a key driver of long-term performance. In our view, equity valuations open the conversation to possible need for portfolio re-balancing to potentially reduce risk and bolster long-term performance.

Conclusion

Incorporating the Equal-Weight S&P 500 index strategies into portfolios reduces exposure from Mega-Cap technology stocks and increases exposure to a potentially underweight set of stocks based on industry, size, and valuation.

Related: The 5 Essential COIs

[1] The most referenced study on smaller company outperformance is the Fama-French Three Factor model developed by Universify of Chicago professors Eugene Fama and Kenneth French.