Written by: Ivan Martchev

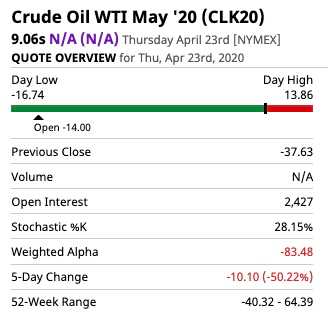

If it weren’t for the elimination of the uptick rule in 2007 and the subsequent infiltration of high-speed computerized trading, the volatility in the stock market would not be so high. The same is true for the commodity markets, even though the rules of trading there have always been different. The most extreme case of “computers gone wild” is the recent trading in May 2020 WTI crude oil futures (CLK20), where the last trade in the contract was a positive $9.06 one day after the contract settled at negative $37.67.

The last day the contract was traded, it had a daily range of minus $16.74 to plus $13.86 – a $30 daily range. The previous trading day, when we went as low as minus $40.32 intraday, the daily range was $60.

I understand that the oil market has an imbalance. I understand that the world used to use 100 million barrels per day in crude oil and that number dropped to 70 million very quickly due to coronavirus-related mandatory shutdowns. Since production cuts were not as fast as the drop off in demand, a supply glut rapidly built up. Still, I think computerized trading obviously added to the price volatility.

I asked a futures trader with decades of experience what happened in the May 2020 WTI futures contract and he said very simply: “It’s computers.” Algorithmic systems buy strength and sell weakness at the speed of light. They don’t make the markets more liquid; they make them more volatile in times of stress.

My source, who has decades in the trenches of the futures markets, trades futures for a living. He said he has had to change the way he trades dramatically in the past 10 years as “the price just kept moving away from me by three ticks” as the algorithmic trading systems “sniffed out” his limit orders.

Crazy things may happen with the June 2020 WTI futures contract (CLM20), as oil storage limits may be even tighter, as it seems that the cuts in oil production globally have not been as fast as the drop off in demand, which is unlikely to come back as fast as it fell. Still, all of this information was well known on the day before the CLK20 contract had a $60 daily range and went as low as -$40.32. Gut feeling tells me that if it were not for computers gone wild, the May 2020 WTI contract may have not gone negative at all.

For more on how computerized trading that front-runs investors and costs them billions of dollars per year, read Flash Boys: A Wall Street Revolt by Michael Lewis, or see his famous 60 Minutes interview, "Is the U S stock market rigged?"

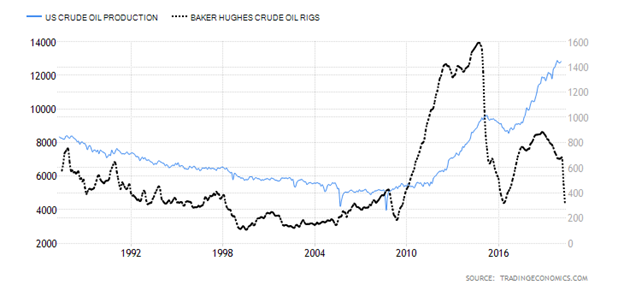

A Wave of Oil-Related Bankruptcies is Coming

Because the tripling of crude oil production since 2008 was caused by unconventional methods known as “shale oil,” we are likely to see U.S. rig count fall to all-time lows and U.S. production being cut by a large amount, possibly half. This is because shale oil has production methods that are significantly more expensive than conventional drilling methods. I doubt that with the present oil price that settled at the end of last week at $19.78 on the June 2020 WTI futures contract any shale production is profitable.

Since the reopening of the economy is not going to be as fast as the shutdown, I don’t believe the oil price will come back to make shale oil profitable in 2020. Because most of the shale oil was financed with debt, there are coupon payments that have to be made and falling revenues, which are likely to fall further in a depressed oil price environment. There is only so much oil you can produce at a loss and then you have to store it, which we know won’t be an option soon. The only way to go forward is to shut uneconomic production, which means bankruptcy for high-cost producers and many oil-service companies.

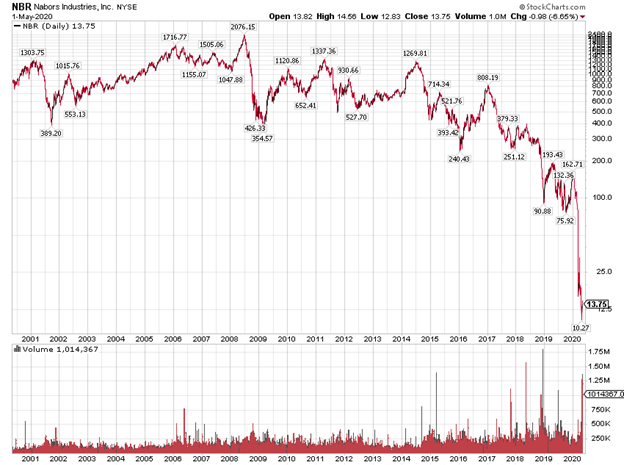

Diamond Offshore already filed for bankruptcy in late April. Nabors Industries is a land driller, but its probability of filing for bankruptcy in 2020 is exceptionally high, given how much drilling budgets will be cut and how fast the oil price will recover in order to rejuvenate any drilling activity.

The Nabors conference call on May 6 will be interesting for any insights as to where the oil service industry is going at the time of the biggest demand shock it has ever experienced. A 1-for-50 stock split that was introduced for NBR stock in late April does absolutely nothing to change the economics of drilling for oil. Right now, there aren’t any economies for most shale oil operators.

The present coronavirus pandemic illustrates well the absurdity that is still being taught in business schools – that if one has a viable business model, the financing of the business between equity and debt is irrelevant. This hopelessly flawed academic model is absurd because it assumes the linearity of economic growth and the business environment. While the coronavirus shock is extreme, neither economic growth nor the business environment are predictably linear. Interest payments on debt are an obligation, while dividend distributions to equity holders are a discretion of the board of directors for a public company.

How many businesses, not only oil-related, do you think wished they only had equity financing now?

Navellier & Associates does not own Diamond Offshore (DO) or Nabors Industries (NBR) in managed accounts or our sub-advised mutual fund. Ivan Martchev does not own Diamond Offshore (DO) or Nabors Industries (NBR) in personal accounts.

DISCLOSURE:The views and opinions expressed in this article are those of the contributor, and do not represent the views of Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.

Related: Acting on the Prospects for the Oil Rally’s Continuation