Your social media performance is fluid – ups and downs are expected. For some advisors, social media is not providing the ROI they expected.

This blog post will outline why your social media might not be working, and what you can do to fix it. Let’s start by looking at how social media performance is measured before diving into 12 possible ways to fix your social media performance.

How is Social Media Performance Measured?

Social media performance can be measured by your platform’s analytics. Naming conventions change between metrics, but the results often remain the same. Here are a few to keep an eye on:

- Engagement: This is a measurement of interaction with your posts, including likes, shares, comments, etc.

- Impressions: How often your content is seen is measured by impressions. If your content appears on someone’s screen, it counts as an impression.

- Reach: Impressions measure total views, while reach measures unique views.

- Followers: This is a measurement of how many users will receive your content in their feed.

12 Ways to Fix Declining Social Media Performance

Social media performance is based on a variety of factors and will depend on your unique profiles and analytics. The tips below provide general tips to improve overall social media performance. Keep this in mind when adjusting your channel.

1. Invest in the Long-Term

Social media does not provide immediate ROI. It’s an active process of building brand awareness to benefit your firm in the long run.

If you’re not receiving much kickback from social media, but using all of the right strategies, then try to give it a bit more time.

One thing to do in the meantime is to establish a consistent digital marketing schedule. The schedule below provides a fantastic overview of both a weekly, and bi-weekly schedule:

2. Engage Other Users

To be successful on social media, you need to be social. Only posting content won’t bring results.

Instead, develop a pattern of interaction using the 80/20 method – for every post you create, comment on 5 other users’ posts. Doing so offers the opportunity for reciprocity, and garners the attention of new users.

For example, check out how Brendan Frazier responds to Abby Morton, CFP® and Justin Horsch in this LinkedIn comment chain:

3. Show Your Personality

The biggest strength of social media is the opportunity to showcase your firm’s personality. Doing so helps differentiate your firm from others, and provides a platform for your values and services.

Don’t be afraid to share personal stories, highlight your team members, celebrate your community, etc. Sharing this sort of content can increase the chance that your content resonates with another user. Users that can relate to your firm are often more likely to select your firm when seeking out financial services.

For example, Chad Chubb CFP®, CSLP®, provides a comedic glimpse into the week, which is both relatable and entertaining:

4. Focus on the Reader

When content isn’t performing well it can often be because of the focus. Some advisors, when first posting on social media, will ask others to read their content, then provide a link to a new blog post or article.

The problem with this approach is that readers’ have no reason to click (unless the title is very compelling).

To increase content engagement, and attract users, your posts need to be written toward your reader. The focus needs to be on the value your content will bring, that way they are naturally inclined to click.

For example, check out the differences between these two posts from Thomas Kopelman:

5. Get Rid of Misconceptions About Social Media

When social media performance starts to dip, it’s easy to blame it on the platform.

As number 1 on this list points out, the results of social media are not immediate. It’s a long-term investment that can provide significant benefits.

In fact, according to Putnam Investments, financial advisors averaged $4.9 million AUM from social media.

But social media can also be frustrating to take on, especially for firms with new pages. If you’re unsure about keeping up with 3 channels, then consider investing in one to start.

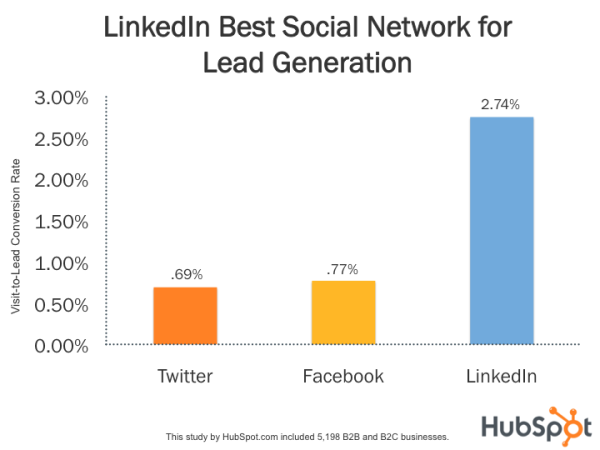

LinkedIn is a fantastic location to being, as it’s a natural location for business owners and financial information. And, according to Hubspot, LinkedIn is also the most effective platform for generating leads:

6. Understand Each Platform’s Algorithm

Each social media platform prioritizes different features to determine the success of a post. For example, LinkedIn prefers that users avoid using links within their posts, as it wants to keep visitors on the site.

Designing your posts to appeal to the algorithm of your chosen channel can help increase your social media performance.

We cover algorithms for Facebook, Twitter, LinkedIn, Instagram and YouTube on our blog. So check out this post on understanding social media algorithms if you’re looking to learn more!

7. Add Context to Content

Many times, advisor content will discuss the same challenges using the same language. Social media performance will thus begin to suffer due to a lack of differentiation.

In fact, according to Pershing, over 60% of investors believe it’s hard to tell the difference between advisors because they make the same promises. To address this problem, consider the context of your post. Context tells your readers exactly who your post helps and how.

For example, check out the difference between these two sentences:

8. Optimize Your Profile

The source of content is important, and setting up an optimized profile is important, no matter what platform you’re on.

Each platform contains its own requirements, so here’s how you can optimize your profile for the following platforms:

9. Check the Calendar

Sometimes, a decline in social media performance is not the result of your strategy, but rather the time of year.

This is especially the case in certain industries, as users who follow an advisor’s content may be out of the office for Summer and the holidays.

One way to look at general seasonality is to use a tool like Google Trends. Using Google Trends, you can search different keywords that apply to your website and services to see if seasonality affects any of them.

For example, here’s a general search of the term “Financial Advisor”, showing a few spikes near the end and beginning of the year.

10. Use the Right Platform

Sometimes a decline in social performance isn’t your content, but rather the platform or channel you’re using. Each social media channel is known to attract a different audience.

If you’re not seeing the performance you want, consider trying a different channel.

Alternatively, consider adjusting your content to appeal to the platform’s audience. Many social media users will often use more than one social media platform. If they follow you on both, they may not engage the post on one platform if they’ve seen it on another.

Here are some of the common audiences on each social media platform:

11. Focus On a Niche

Keep your content focused on your niche. Posts written towards a broad audience lack the strength to appeal to readers, especially in the constant stream of social media. Your content needs to catch the reader’s attention by appealing to their exact interests.

Who are your typical clients? What are your services? What makes your firm unique?

Similar to focusing on your reader, and providing context, maintaining a niche ensures your content is relevant.

For example, Mindy McCubbin, owner of Truman Wealth Advisors, posts content that focuses on reducing client stress, as shown in posts and summarized in the following headline on the Truman Wealth Advisors Facebook page:

12. Set Aside Enough Time

Establishing and growing your social media is essential to your digital presence. But sometimes our social media doesn’t perform well, simply because there isn’t enough time.

To resolve this, consider a few options:

- Hire an intern. Hiring an intern to assist part-time can be a great way to provide employment and advisory experience to a college student.

- Allocate time on your calendar. Sometimes, social media just falls under the cracks. But scheduling your posting and utilizing scheduling software like Hootsuite can help.

- Utilize marketing automation. Writing and scheduling posts takes time. But the hardest part of social media is actually finding noteworthy content. To help, consider using a service like Lead Pilot to provide customizable, advisor-focused content for social media and email. And with built-in analytics and lead scoring, you’ll be able to distribute and measure the success of your campaigns from one dashboard.

Wrapping Things Up

Social media offers a unique opportunity for business growth. Sometimes though, social media doesn’t work the way we want it to. This could be for a variety of reasons, and whenever you see a dip in performance, consider the items on this list. By making adjustments, you can put your social media accounts back on track.

Related: The Number One Reason Social Media Doesn't Work for Most Financial Advisors