Written by: Caleb Lund, CAP® and Hayden Adams, CPA, CFP®

Using retirement accounts to maximize the tax benefits of charitable giving

Many high-net-worth individuals have significant assets in IRAs and other retirement accounts that they don’t need to provide for their living expenses. For philanthropically minded clients, these accounts can be a great source to fund charitable giving and offer potential opportunities to reduce taxes. Here are two ways that you can add value to your clients by helping them develop a tax-efficient giving strategy.

1. Give to charities (excluding donor-advised funds) during retirement years through a qualified charitable distribution (QCD).

Starting at age 73 the IRS mandates IRA owners to take annual required minimum distributions (RMDs). Failure to take these withdrawals could subject the owners to stiff penalties.

Retirement-age individuals and couples may not want to take an RMD for various reasons. They may have other sufficient sources of income for certain years. Also, the withdrawal, which is subject to ordinary income tax, may push them into a higher tax bracket, adversely impacting Social Security payments and Medicare benefits.

Thankfully, charitably minded individuals and couples age 70½ and older can take advantage of a tax-smart strategy by making a QCD, also known as a charitable IRA rollover. The QCD allows a donor to instruct an IRA1 administrator to send up to $105,000 per year—potentially covering all or part of the annual RMD—to one or more qualifying public charities, excluding donor-advised funds.2 Couples who submit tax returns with married filing jointly status each qualify for annual QCDs of up to $105,000, for a potential total of $210,000. Donors can also direct a one-time, $53,000 QCD, as part of the overall $105,000 limit, to a charitable remainder trust or charitable gift annuity as part of recently passed SECURE Act 2.0 legislation. So with QCDs, more of a client’s assets can be used to support their favorite charities that are making a difference.3

The IRA assets go directly to charity, so donors don’t report QCDs as taxable income, which means they don’t owe any taxes on the QCD. And because the QCD is not taxable, the donor won’t receive a tax deduction from the donation; however, some donors may find that QCDs provide greater tax savings than other methods of charitable giving.

Case study: enhancing tax savings with a QCD gift

Bob is 75 years old and is required to take an RMD from his traditional IRA. Bob’s IRA is valued at $1,050,000, resulting in a projected RMD of $42,683. His ordinary income in 2024 is $80,000 and he is a single filer.

Option 1: Bob’s AGI is projected to be $80,000, but if he takes his RMD income of $42,683, it will increase his AGI to $122,683. If Bob then donates the money from his RMD to charity, he can claim an itemized deduction of $42,683, excluding any other claimed deductions. This results in $80,000 in federal taxable income.

Option 2: However, if Bob instructs his IRA administrator to direct his RMD as a QCD to an eligible charity, the RMD amount is excluded from Bob’s taxable income. Bob then takes the standard deduction of $14,600 for 2024, plus an additional standard deduction of $1,950 because Bob is over 65 and has a single filing status. Therefore, his standard deduction totals $16,550. As a result, his federal taxable income is reduced to $63,450.

This example is only for illustrative purposes. Both options assume no Social Security income and that the charitable gift is to an operating charity.

2. Give beyond lifetime by naming a donor-advised fund account or other public charity as a charitable beneficiary.

Not all assets owned are treated the same when passed to heirs. In fact, a unique feature of traditional IRAs is that heirs pay income taxes on the inherited assets at their own income tax rate at the time of withdrawal.

This tax feature is why public charities can be ideal beneficiaries of IRA assets. Public charities, including donor-advised funds, generally do not pay income tax on IRA income, which means every penny of the donation can be directed to support the donor’s charitable goals.

What’s more, donors can use IRA assets to fund gifts, such as charitable remainder trusts, that provide other benefits. For example, charitable remainder trusts may:

- Provide a steady stream of income for heirs;

- Enable an estate to claim an estate tax deduction, if needed;

- Fund a charitable legacy by naming a donor-advised fund account or other public charity as the beneficiary of trust assets.

Naming a charitable beneficiary is easy to do and may result in substantial tax savings for a donor’s heirs and estate.

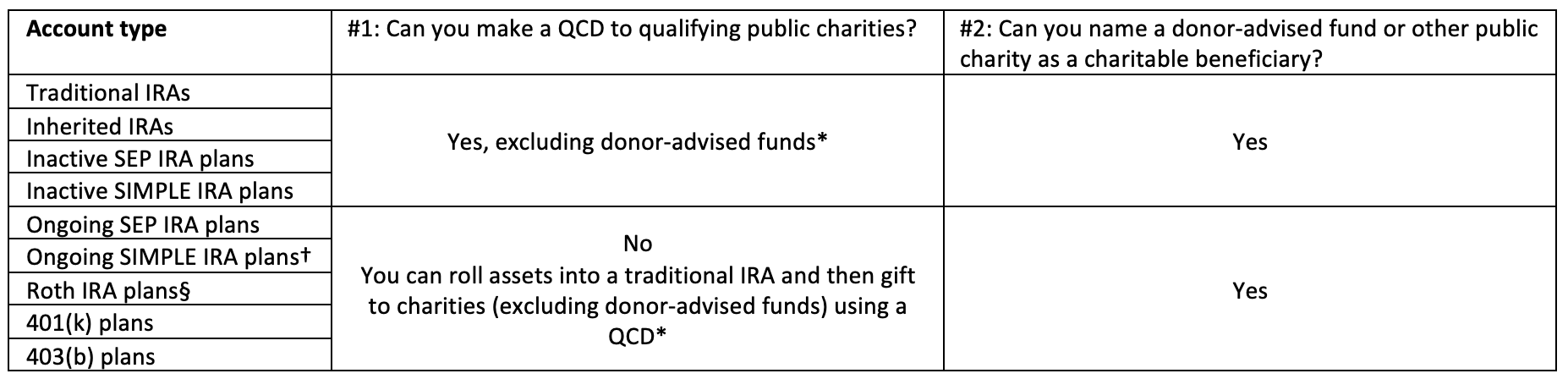

Ways clients can give to charity through an IRA and other retirement accounts

* Donor-advised funds do not qualify to receive QCD gifts.

† Generally, contributions to SIMPLE IRAs must be held for two years before they can be rolled into a traditional IRA.

§ Roth IRAs are not subject to RMDs during an accountholder’s lifetime and distributions are generally tax-free and therefore there may be no tax benefit to rolling over Roth IRA distributions. There also may be circumstances in which a QCD can be made from a Roth IRA. Clients should consult their tax advisors about their specific situations.

Interested in learning more?

Schwab Charitable™ is dedicated to helping you increase the impact of your clients' giving and deepen your client relationships. Review our collection of advisor resources for tax-smart philanthropy.

Related: Maximizing Tax Benefits by “Bunching” Charitable Contributions

1 401(k), 403(b), and ongoing SEP or SIMPLE plans do not qualify for the QCD gift option, but assets from these accounts may be rolled over into a traditional IRA and thereafter gifted to charity using a QCD.

2 Operating charities, or qualifying public charities, are defined by Internal Revenue Code section 170(b)(1)(A). Donor-advised funds, supporting organizations, and private foundations are not considered qualifying public charities.

3 Donors cannot receive any benefits from making a QCD, such as courtside seats at a university’s basketball game, participation in a charity auction, or payment of fees for a charity golf tournament. Donors may be able to use a QCD to fulfill a donation pledge but should consult with a tax or legal advisor on specific limitations.

Schwab Charitable™ is the name used for the combined programs and services of Schwab Charitable Fund™, an independent nonprofit organization, which has entered into service agreements with certain subsidiaries of The Charles Schwab Corporation.

Schwab Charitable Fund is recognized as a tax-exempt public charity as described in Sections 501(c)(3), 509(a)(1), and 170(b)(1)(A)(vi) of the Internal Revenue Code. Contributions made to Schwab Charitable Fund™ are considered an irrevocable gift and are not refundable. Please be aware that Schwab Charitable has exclusive legal control over the assets donors have contributed. Although every effort has been made to ensure that the information provided is correct, Schwab Charitable cannot guarantee its accuracy. This information is not provided to the IRS.

A donor’s ability to claim itemized deductions is subject to a variety of limitations depending on the donor’s specific tax situation. Donors should consult their tax advisors for more information.

Schwab Charitable does not provide specific individualized legal or tax advice. Please consult a qualified legal or tax advisor where such advice is necessary or appropriate.

© 2024 Schwab Charitable Fund. All rights reserved.

(0224-F2RD)