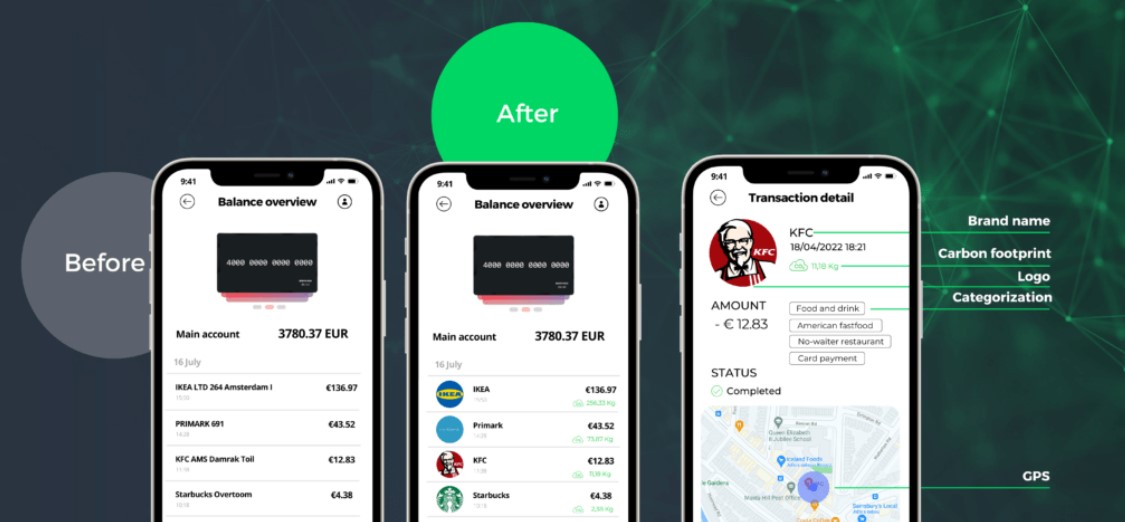

I’ve said that my old bank is deficient for some time. Specifically, no alerts of transactions so I have to open the app to see when something is paid; no detail of transactions, just something like ABC CORP TX 3201984 on my statement; zero detail about where I’m spending money, just a date and a place name that often does not correlate with the merchant, e.g. 22 FEB STRIPE; and so on and so on.

A lot of that will change soon for two reasons: SPAA and AN4569.

???

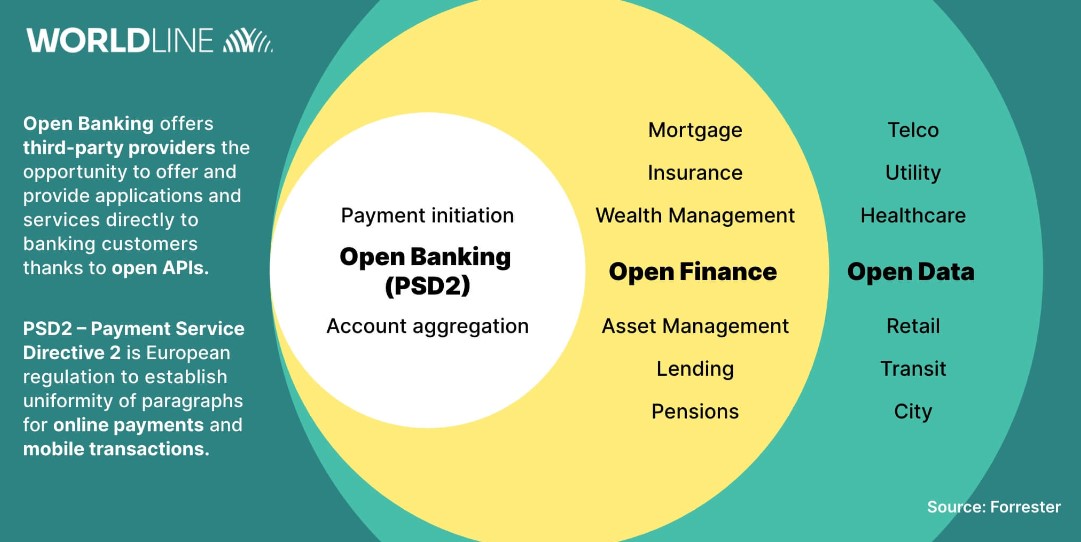

OK, let’s start with SPAA or, as it’s actually called, the SEPA (Single Euro Payment Area) Payment Account Access scheme. It’s the expansion of the Payment Services Directive second directive (PSD2) to PSD3, which will incorporate true Open Banking and not just a Payments API (Application Program Interface).

How’s that for a set of acronyms: SEPA, SPAA, PSD2, API?

[Ed: I hate the fact that all industries use acronyms to confuse people, but that’s another story]

The SEPA Payment Account Access (SPAA) scheme is the newest EPC scheme that covers the set of rules, practices and standards that will allow the exchange of payment accounts related data and facilitates the initiation of payment transactions in the context of ‘value-added’ (‘premium’1) services provided by asset holders (i.e. Account-Servicing Payment Service Providers (ASPSPs) to asset brokers (e.g. Third Party Providers (TPPs).

Oh jeez, here we go again.

Simplifying it all down to basics, I see it as the application of Open Banking, which the UK launched in its implementation of PSD2, to all of Europe.

What’s the difference between an OpenAPI under PSD2 versus Open Banking under PSD3? For me, it’s primarily around data enrichment around payments such that all transactions should be able to show you who paid what, when and where.

According to the EPC, the key benefits will be:

- It builds on investments done in the context of the revised Payment Services Directive (PSD2).

- Managed as a scheme, developed collaboratively by the retail payment industry (supply and demand) and the end-user community, as represented in the ERPB, and with the support of EU institutions.

- It enables ‘premium’ payment services beyond PSD2 in a way ensuring harmonisation, interoperability and reachability across Europe.

- Asset holders expose information and transactions through the scheme to asset brokers for a fee (from asset brokers), with prior consent from the asset owner.

- It takes into account the input from major European standardisation initiatives active in the field of ‘PSD2 APIs’.

- It could be a stepping-stone towards ‘open finance’ beyond payments and ‘open data’ beyond finance.

Interestingly, the UK Future of Open Banking Strategic Working Group (SWG) just published a report about where Open Banking is going in Britain. This is a group created in March 2022 by the UK Government to bring together HM Treasury, the Competition and Markets Authority (CMA), the Financial Conduct Authority (FCA) and the Payment Systems Regulator (PSR) to build a new Joint Regulatory Oversight Committee (the Committee) as part of the Government and regulators’ commitment to build on the success of open banking.

There's a lot of info in there, but the key core activities they cite for the future include and entity, possibly replacing the Open Banking Implementation Entity (OBIE), that would be charged with:

- Maintaining the Open Banking Standard to ensure it stays relevant

- Collecting and collating MI (messaging interfaces), and obtaining additional evidence to help decision-making

- Monitoring standards conformance

However, there was some divergence as to whether the future entity would provide evidence and outputs to regulators or if it would be given powers to enforce adherence and conformance on participants.

Meanwhile MasterCard's AN4569 is targeting the same issue. AN4569 is a mandatory requirement from MasterCard under its revised rules of 2020 that mandates by the end of this year (October) that all issuers provide enhanced merchant data to customers. This includes showing accurate merchant names, correct logos, the contact details (telephone and website) and much more, such as payment location and links to Google Maps for example.

Source: TAPIX

From October 2023, all card issuers must provide enriched payment data to cardholders under Mastercard’s revised standards.

It’s all about enriched payment data. SPAA and AN4569 are all about enrichment of data so that customers get a much better idea of what they’ve paid where and when. This is a must-have in today’s digital world.

Related: Why the 1% Will Always Be the 1%