Written by: Caleb Lund, Hayden Adams and Michael Townsend | Schwab Charitable

Tax-smart philanthropy for 2022: Why it’s important to discuss charitable giving now

Nearly 90% of high-net-worth households in the United States donated an average of $43,000 in 2020,1 bolstering charitable giving to historic levels over the last few years. Some of these generous individuals and families may have also received a larger tax bill than expected, and they’re looking to advisors for guidance to reduce their tax exposure and maximize their charitable impact.

2022 tax environment

While it is unlikely that any U.S. tax law changes will materially impact the current rules around charitable giving this year, it’s still a good time to help clients start planning for the 2022 tax year. Keep in mind that any tax legislation that may be passed in 2022 likely would not be implemented until 2023.

A key factor for determining the tax benefits of a charitable gift is the annual standard deduction amount, which has more than doubled since passage of the Tax Cuts and Jobs Act in December of 2017. For 2022 taxes, single filers may claim a $12,950 standard deduction, while married couples filing jointly can claim a $25,900 standard deduction. This is an increase of $400 for single filers and $800 for married couples, compared to 2021 amounts.

Because of these increases in the standard deduction amount, some taxpayers who historically itemized deductions—including charitable contributions—may find that the total amount of their itemized deductions does not exceed the standard deduction.

However, charitably inclined individuals and families can still maximize their tax benefits through strategies utilizing both itemized and standard deductions, as explained below in the bunching contributions strategy, as well as through key charitable giving incentives in existing tax laws. Annual income tax deduction limits for gifts to public charities, including donor-advised funds, are 30% of adjusted gross income (AGI) for contributions of non-cash assets, if held more than one year, and 60% of AGI for contributions of cash. For clients who make larger contributions, amounts in excess of these deduction limits may be carried over up to five subsequent tax years.

With this basic framework in mind, let’s review eight tax-smart philanthropy tips you may want to explore with your clients in 2022.

Tax-smart giving strategies

1. Contribute appreciated non-cash assets instead of cash.

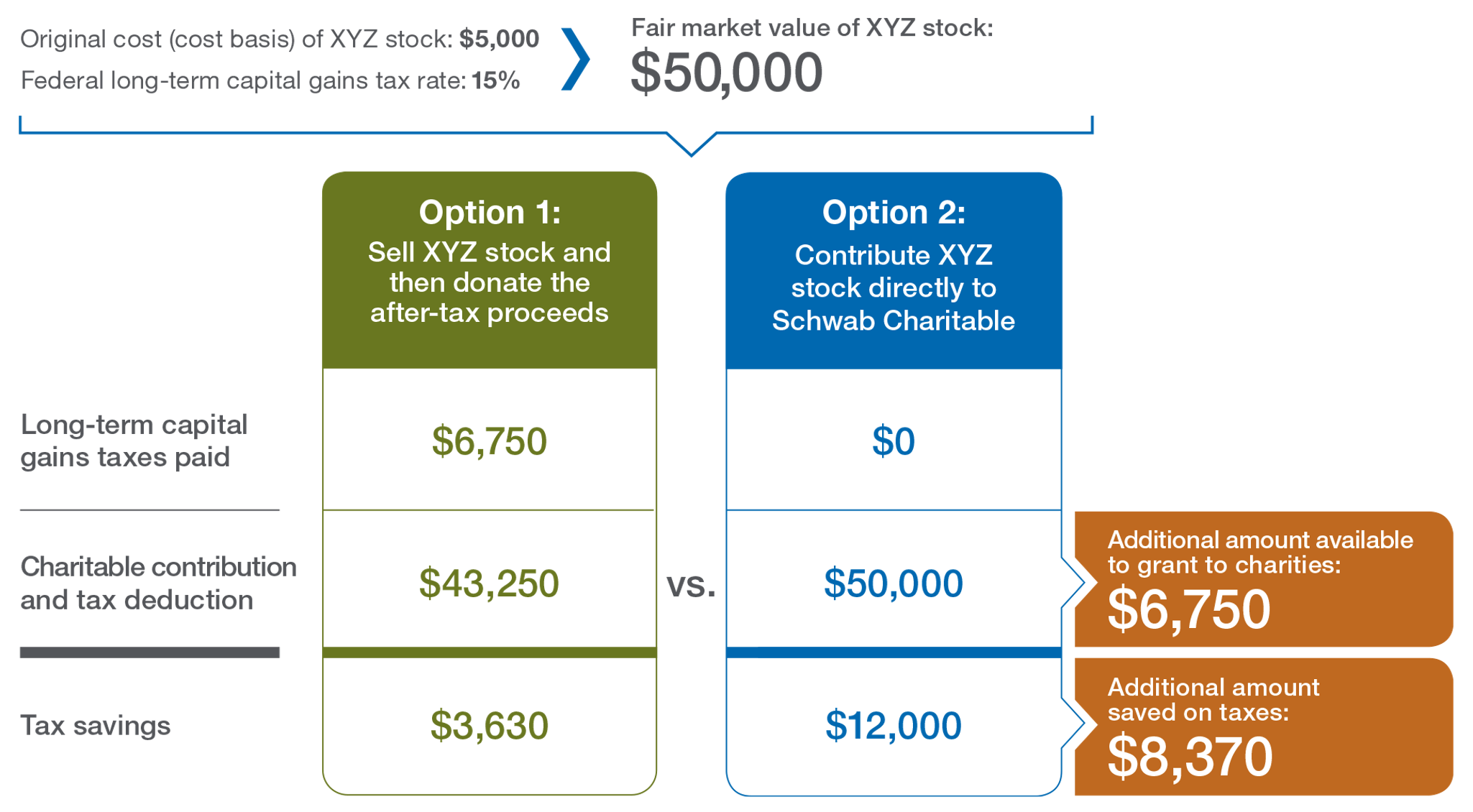

One of the most effective tax-smart strategies for achieving maximum charitable impact is donating appreciated non-cash assets held more than one year. You might be familiar with this concept, but many clients don't realize that it's more tax-efficient to give appreciated assets instead of cash. You can add value and reinforce your role as a trusted-advisor by showing your clients a tax-smart way to give.

Clients who use this strategy can generally eliminate the capital gains tax they would otherwise incur if they sold the assets first and then donated the proceeds.

Eliminating the capital gains tax—15% or 20%, depending on the client’s income level—can increase the amount available for charities by up to 20%. It can also increase a client’s tax savings, as shown in the example below.

This hypothetical example is only for illustrative purposes. The example does not take into account any state or local taxes or the Medicare net investment income surtax. The tax savings shown is the tax deduction, multiplied by the donor's income tax rate (24% in this example), minus the long-term capital gains taxes paid.

2. Use a part gift, part sale strategy to offset capital gains tax from investment portfolio rebalancing.

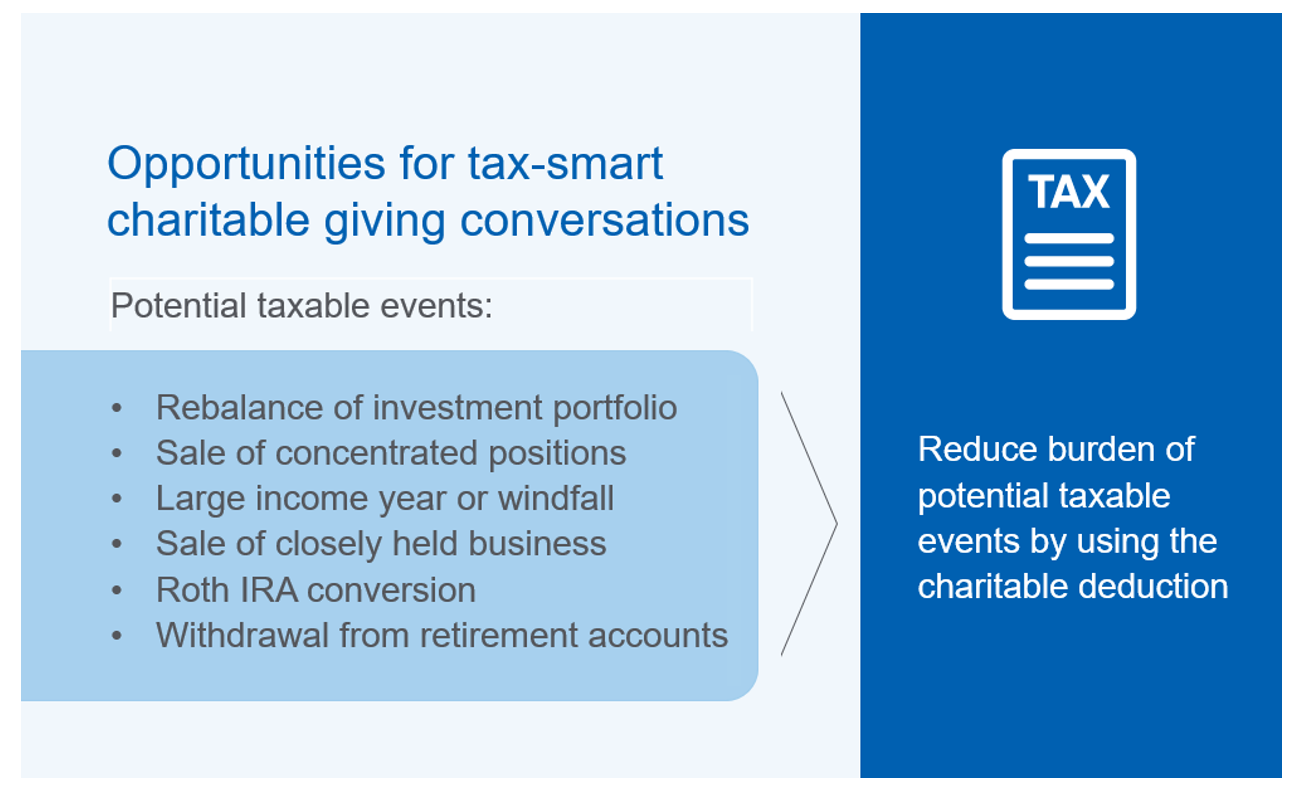

This is a powerful conversation for you to potentially initiate whenever you are rebalancing your clients' portfolios or discussing strategies for concentrated positions. Help your clients understand that each time an appreciated position is sold in one of their taxable (e.g., non-retirement) accounts, a taxable event occurs, but they can donate shares to eliminate the taxes they would owe.

Tied to strategy 1 above, clients who itemize deductions can utilize a part gift, part sale strategy to reduce the tax impact of rebalancing. This is accomplished by claiming an income tax deduction for donating some appreciated assets to charity, in an amount that offsets gains from selling other appreciated positions, within the same tax year. For example, for your clients who plan to sell shares of highly appreciated stock, you may help them develop a strategy to offset taxable income by charitably gifting other highly appreciated shares in 2022, with a goal to achieve net zero tax liability.

3. Bunch two years of contributions into 2022.

Some clients may find that the total of their itemized deductions for 2022 will be slightly below the level of the standard deduction. In that circumstance, it could be beneficial to combine or “bunch” 2022 and 2023 charitable contributions into one year (2022), itemize deductions on their 2022 tax returns, and take the standard deduction on 2023 taxes.

In addition to achieving a large charitable impact in 2022, this strategy could help your clients obtain a larger two-year deduction than two separate years of itemized deductions, depending on their income level, tax filing status, and giving amounts each year.

4. Make a Qualified Charitable Distribution (QCD) of Individual Retirement Account (IRA) assets.

Regardless of whether your older clients itemize or take the standard deduction, individuals over the age of 70½ can direct up to $100,000 per year tax-free from their IRAs to operating charities through QCDs.* By reducing the IRA balance, a QCD may also reduce the client's taxable income in future years, lower their taxable estate, and limit IRA beneficiaries' tax liability.

5. Use a charitable deduction to help offset the tax liability on a retirement account withdrawal.

This strategy may be used by individuals over age 59½ (to avoid an early withdrawal penalty) who will itemize deductions for 2022. As with the above strategy, a withdrawal offers the additional benefits of potentially reducing a client's taxable estate and limiting tax liability for account beneficiaries.

6. Use a charitable deduction to help offset the tax liability from converting a retirement account to a Roth IRA.

Clients who itemize deductions and have tax-deferred retirement accounts, such as traditional IRAs, can use charitable deductions to help offset the tax liability on the amount converted to a Roth IRA. The primary benefits of a Roth IRA are tax-free growth, potentially tax-free withdrawals (if holding period and age requirements are met), no annual required minimum distribution, and elimination of tax liability for beneficiaries (depending on the timing).

7. Establish and contribute to a charitable remainder trust or charitable lead trust.

If you have clients who are interested in a source of income for themselves or family members, a charitable remainder trust (CRT) on its own or coupled with a donor-advised fund account may be a great option. A CRT combines a guaranteed income stream with a donation to charity. In this structure, once a client makes a charitable contribution, the trust makes annual payments to the client or other people for life or a term of up to 20 years. At the trust’s termination, a charitable beneficiary receives the remaining assets.

For clients looking to reduce gift or estate taxes while also supporting charity during their lifetime, a charitable lead trust (CLT) might be a good choice. A CLT is the reverse of a charitable remainder trust—that is, charities are paid first. This trust makes at least annual payments to a designated charity or group of charities for a set period of time. After that period, the trust ends and the balance passes to designated non-charitable beneficiaries, such as the client or their family.

Note that with either trust, it could behoove your clients with donor-advised fund accounts to name a donor-advised fund as the charitable beneficiary. Naming their donor-advised fund account as trust beneficiary provides additional flexibility and time to determine which charity or charities will receive the charitable assets and when the assets will be distributed through grant recommendations.

Setting up and funding a charitable trust is complicated. Clients should consult tax and legal advisors.

8. Open a donor-advised fund account now, while taxes are top of mind, and make tax-deductible contributions at any time before the end of the year.

Tax season is an excellent time for you to initiate charitable giving conversations with your clients and help them plan ahead to reduce taxes and maximize their giving power. A Schwab Charitable account makes charitable giving tax-smart, simple and efficient. Once an account is open, clients have the flexibility to either make one lump-sum contribution or a series of contributions. Any contribution—of cash or non-cash assets—received by December 31 is eligible for a 2022 tax deduction.

If your clients are considering any of the charitable tax strategies highlighted above, you may want to consult with their tax and legal advisors before taking action or encourage them to do so.

Related: Every Dollar Counts: Helping Clients Evaluate a Nonprofit

*Operating charities, or qualifying public charities, are defined by Internal Revenue Code section 170(b)(1)(A). Donor-advised funds, supporting organizations, and private foundations are not considered qualifying public charities.

1. 2021 Bank of America Study of Philanthropy.