It has been said of financial services that there are as many different advisor business models as there are financial advisors themselves. Advisors bring their unique personalities, perspectives, and ways of engaging with their clients to their practices and businesses. The challenge for custodians, wirehouses, independent broker dealers, RIAs, solutions providers, and FinTech companies is in supporting and helping all these unique businesses grow. Most practice management, business development, and service models from these entities tend to be regimented and clustered into service and solutions platforms that address major advisor challenges in the aggregate and are similar in format. This is a wise and efficient way to provide these services at scale, but one that may not address all the particular needs of each individual advisor and their singular vision for their companies and growth goals.

To explore this issue further, we decided to reach out to new Institute members Jim Malgeri, President & COO, and Drew Horter, CEO of Civitas Advisor Solutions – a business development firm for advisors, advisory firms, and financial institutions that is based on partnership, community, and culture. Their core mission is to evaluate and strategically architect a customized business plan, tailor solutions specific to individualized support needs, and then partner with the firm on a guided implementation and execution plan. We asked Jim and Drew questions to explore their perspectives on building a firm to be the “Advisor to Advisors” and address the changing business development needs for advisors in this hyper-competitive business environment now being driven by an accelerating rate of change.

Hortz: What is your motivation in launching Civitas and what are the industry challenges you are addressing?

Malgeri: The motivation for launching Civitas Advisor Solutions is truly based on an altruistic quest to help advisors succeed personally and within their advisory practice. Our name, “Civitas”, is derived from the Latin meaning “Community” with the firm’s core pillars being Culture, Community, and Partnership. Our goal is developing a community of like-minded advisors seeking business development support change from the big box financial institutions, broker/dealers, and RIA platforms and wanting to incorporate the newest competitive thinking and resources available to grow their individualized businesses.

Horter: Currently financial institutions and advisor services providers offer transitioning brokerage advisors & independent financial advisors a "platform" with a variety of services. In today’s business environment, this off-the-shelf approach can be too restrictive, outdated, and costly to many advisors & RIAs. Many of these advisor support platforms may not be up to date with the accelerating changes happening across the industry in technology, business model innovation, changing client perspectives, and new digital client engagement strategies. Advisors and RIAs are transitioned into an independent "platform" only to be offered a static stack of services for some basis points charges. The result is advisors and RIAs paying up to 30bps or more in some cases for a "platform" with tiered generic services but also over time paying the platform provider in basis points through increased AUM growth.

Hortz: How did you purposely design your program to address these challenges and provide a different level of support for advisors and their businesses?

Malgeri: The genesis of Civitas Advisor Solutions is creating and implementing the next generation in business solutions and support for advisors & RIA's. We engage brokerage advisors and RIAs through free consultations (no limit on number of initial conversations) initiating a discovery period assessing their current state. The Civitas team helps define advisor and practice goals. Multiple business options are created and presented for discussion and selection. Then a customized plan - unique to that advisor and practice - coupled with specific solutions and ongoing support is established for a flat fee. Bottom line, Civitas cuts overhead expenses from your current custodian or B/D and tailors solutions - for example, marketing, compliance, technology, etc. - that benefit you and eliminates basis point charges.

Hortz: Can you further discuss some of the differentiating components in your advisor support model?

Malgeri: Our main differentiator is the open architecture allowing for unlimited solutions that our team customizes to suit the needs of each advisor or RIA. In addition, Civitas was developed to incorporate a consultative arm that consults and plans for each advisor or RIA. The Civitas team will consult, design, execute, and support: advisors, RIA’s, Fintech firms, banks, and institutions ranging from 50M to multi-trillion-dollar firms.

Hortz: How exactly do you evaluate and strategically architect a customized business plan for each advisor or advisory firm client? What criteria and process do you use?

Horter: Leveraging our extensive advisory, institutional, and consulting experience, we utilize a consultative approach that entails behavioral analysis and current state practice analysis. We capture data points regarding the advisor, advisors’ team, and practice to frame strategic options in developing a plan. We break down our process into Discovery, Design, Plan Development, Execution, and Support. Our background is based on extensive project management and Agile/Scrum methodology.

Hortz: What is the range of support services you offer your clients?

Malgeri: We do not consider our offering as “services” but rather “consultation” that wraps customized solutions meeting the needs of each client. Our range of solutions are limitless, and Civitas builds to suit advisors, registered investment advisors, or financial institutions.

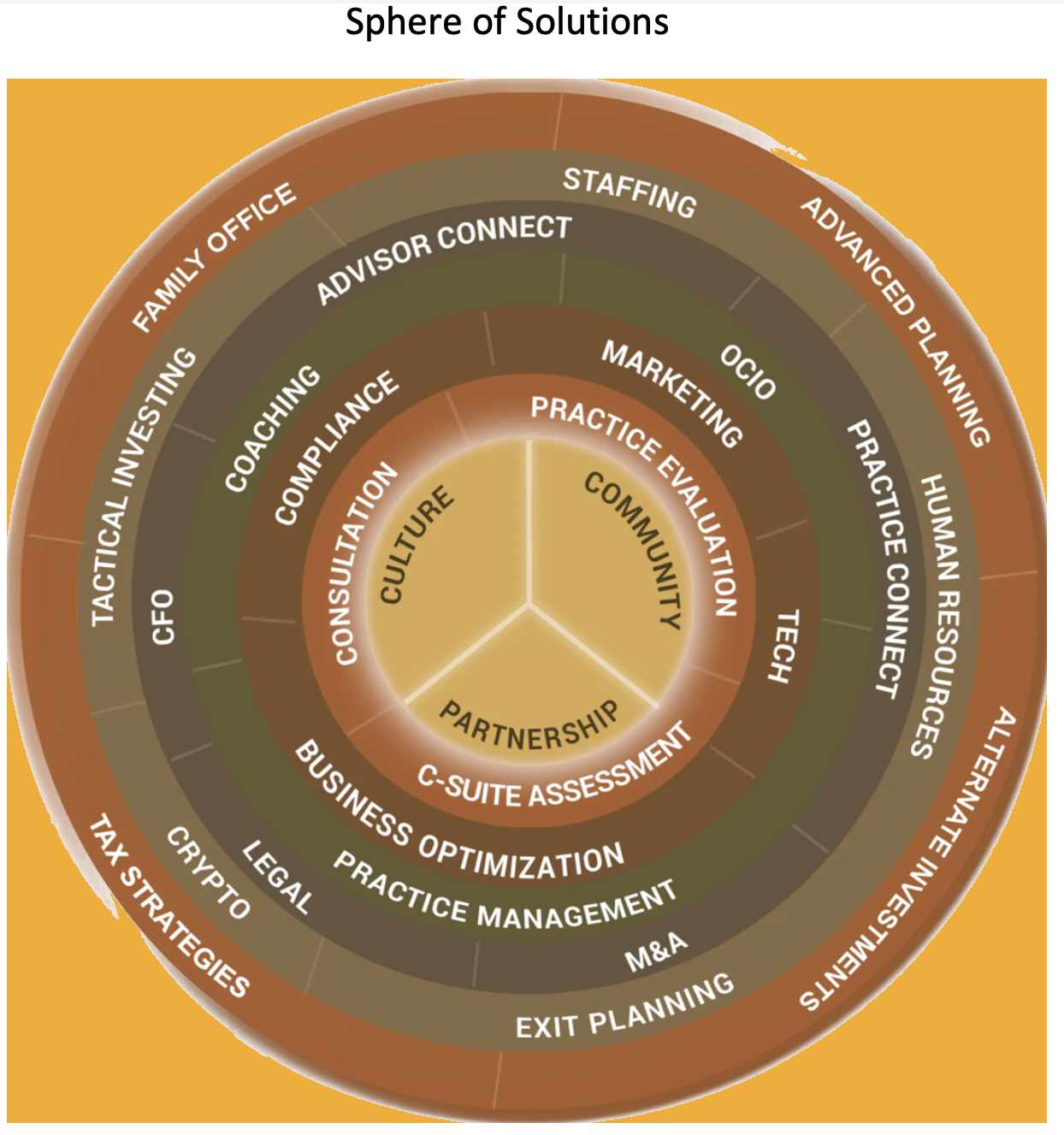

We start with offering culture, community, and partnership. These pillars are the most important offering we can offer anyone. And from there, we provide our Sphere of Solutions.

Hortz: Can you tell us about the extended ecosystem of support services you have curated for your advisor clients and how you work with them as strategic partners in your efforts?

Malgeri: My team and I conduct stringent due diligence on every future strategic partner vendor and only a select few partners make it onto our roster list. We work with each strategic partner to tailor solutions based on our knowledge of the market and expectations of client needs.

Horter: When we analyze an advisor’s practice, we not only look at their operations, compliance, practice management, OCIO services, etc., but we also work with all of our strategic partners as to how we can help the advisor firm run more smoothly, grow faster, and still provide the quality of a balanced work/life relationship.

During the first year or two we are constantly coaching, mentoring, and upgrading the advisor’s strategic business opportunity plan. Too many advisors work “in the business” but do not work “on the business”. We can see opportunities and find solutions for them sometimes they do not see. We are laser focused on meeting agreed upon goals and benchmarks.

Hortz: Any general recommendations or advice you would like to share with advisors and financial institutions on developing their business development plans?

Malgeri: For advisors on developing their business plans, we recommend in general that you start by designing your 30K foot vision of your business to conceptualize your business model - create a vision board, establish your personal and business goals, establish your brand and story. With that as a base, break down that vision into segments, prioritize the segments from highest to lowest, create achievable tasks off your prioritized segment and focus your energy on completing the highest prioritized tasks within your segment. We would work with advisors at every step to help analyze, define, and implement strategies.

Horter: For Financial Institutions, we want to be an extension of the institution and their core services. They can “white label” our solutions and business development process for the benefit of their current advisors or new advisors. Being able to offer as many as ten hours up front with an advisor discussing the process on how to build their Strategic Business Opportunity Plan, without any upfront commitment, is a big selling point to advisors. They can see that we are putting our best foot forward to help them and the broker-dealer or RIA they are working with.

Related: Proactively Identifying and Communicating Financial Planning Disruptions