In today’s highly competitive wealth management world, retaining client relationships and growing AUM are not only primary goals – they’re mission critical. Success means consistently providing an exceptional client experience. A big part of that is your client communications. Do you showcase your expertise and make it easy for clients to reach their goals? Do you proactively provide insights to boost their financial wellness and help with life transitions?

These are just some of the questions you should ask yourself when assessing the impact of your client communications. That’s because every communication makes an impression, whether it’s email, letters, website content, direct mail, advertising or social posts. Consistent, well-crafted, meaningful messages strengthen relationships.

Here are 7 best practices to help you create clear, effective communications that clients will appreciate:

1. Focus on the client

Today’s clients want advice on new investment categories, like Sustainable Investing. They’d also like help to navigate job changes, retirement, and other life events. When you reach out with personalized communications that address each niche’s interests and needs, you’ll naturally strengthen your relationship.

Look at every client communication through their eyes: is it more about them or your firm? For example, do your marketing communications lead with what you’re promoting instead of why clients should care? Do your service communications begin with a marketing message or irrelevant detail? When you focus on what’s important to clients, it demonstrates that you really do put them first.

2. Use a clean, easy-to-read layout

Make your messages easy to scan and understand:

• Use headings to organize information and draw attention to important content.

• Highlight key items in lists with bullets or numbers.

Provide adequate space between bullets and paragraphs for easier scanning and reading.

3. Create a positive tone

Think about how you’d act if a client walked into your office. Make sure your written messages greet and treat your clients with a similar friendliness and attention to their needs. For sensitive issues, use positive phrasing that’s reassuring (such as “to ensure ongoing service” instead of “to avoid cancellation”).

4. Be concise, friendly, and easy to understand

Many of us face information overload. To help ensure your messages get read, include only details that clients need to know, while keeping the tone helpful and friendly. Use short paragraphs with clear, plain language anyone can understand — avoiding industry jargon, abbreviations, most acronyms, and technical language when possible. Being concise is especially critical in your web, social and mobile messages.

5. Include a clear call to action (CTA)

Are you making it easy for clients to respond to your requests or offers? Be sure to list clear, simple actions and deadlines in an easy-to-read format – such as bullets or numbered steps. Clients are more likely to respond if they know exactly what you want them to do. For CTA buttons, keep the text short and action-oriented, such as Get Started or Subscribe.

6. Make it easy for clients to contact you

Your communication may raise questions or require a response, so it’s helpful to provide clear contact information within your letter or email. Let clients know who to contact, how, and when – including days and office hours of contacts or call centers. Make it easy for clients to get help from you – they’ll appreciate that.

With messaging that’s clear, friendly, and client-focused, you help ensure your clients feel understood, valued, and supported through every interaction with your firm.

7. Keep writing lean and clean for the web and mobile apps

When developing content for your website or social posts, start by understanding your intended audience segment. What would be of high importance to them? Consider the four C’s to attract and retain affluent customers.

Of course the first six tips also apply to digital channels, where it’s critical to have a clean, easy-to-read layout, positive tone, and clear, concise message.

“The next generation wants everything digital. Once they get through logging in and accessing their information, what’s visual and exciting? You can embed a video, add graphs or diagrams. It’s much more than transferring a letter onto a digital platform.” ~ Rebecca Macieira-Kaufmann, Founding Member, RMK Group, LLC

Bonus tip: Proof-read, proof-read, proof-read

Ensure every communication looks professional with proper spelling and grammar. Consider reading your message out loud to make sure it sounds natural – it’s also a great way to catch and correct typos or errors in word choice (e.g., there vs. their), which a spell-checker might miss. Proofing your communications is especially important when you’re sending negative news, because a well-written message can help put clients in a more receptive frame of mind.

To sum it up

For 36% of clients, the quality and frequency of interaction with their financial advisor is a top factor in rating their client experience.3 That’s why pairing these best practices with more frequent communication provides a way to solidify relationships and attract prospects. When you speak to the needs of the niches you serve, you can inform and educate in a more personalized way. Well-crafted messages, including those delivered on digital platforms, give you a clear path to stronger client connections. It’s also a key way to differentiate yourself and your firm.

Applying these 7 best practices to your communications can create a big win for your clients, and for your wealth management business too. You increase the potential for higher satisfaction, lower support costs, and more motivated team members. It’s all good!

For more ideas about creating engaging and effective communications for HNW clients, check out 5 ways financial advisors can add impact to client communications.

Related: Promote Your Firm With the Peso Model: It’s Not What You Might Think!

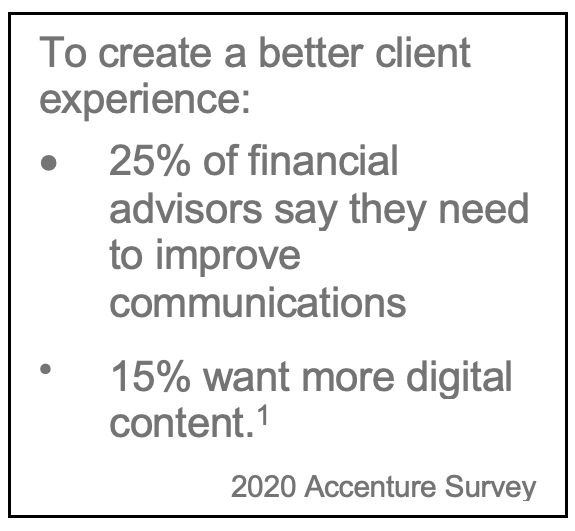

1. Financial advice reimagined, Accenture, Sept 2020

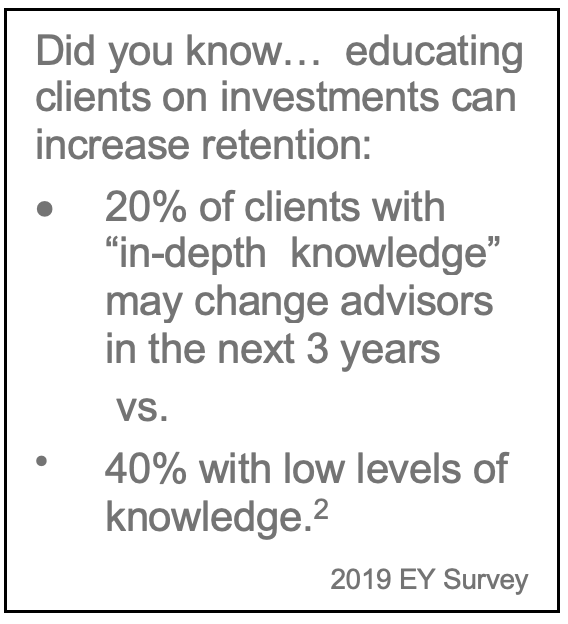

2. When wealth management clients want to switch, will you be their first choice? EY, April 2019

3. How Digital Onboarding can Drive Growth for Wealth Management Firms, AgreementExpress, (no publication date shown, although article sources are from 2016)