Bubble is a dirty word.

Most investors think bubbles should be avoided at all costs, but the truth is:

Buying stocks in the early stages of a bubble can be very profitable.

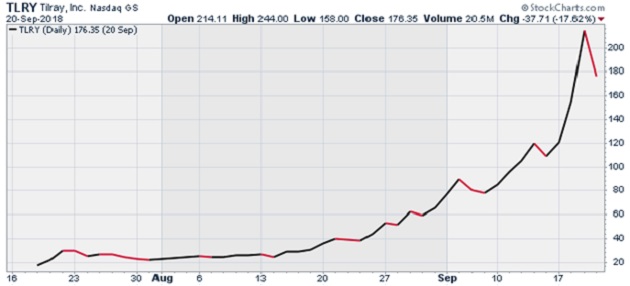

Consider the cannabis bubble.

Back in 2017, marijuana stock Tilray Brands (TLRY) went from just over $20 per share to over $200 in two months!

Source: StockCharts

It went on to crash more than 90% in less than two years.

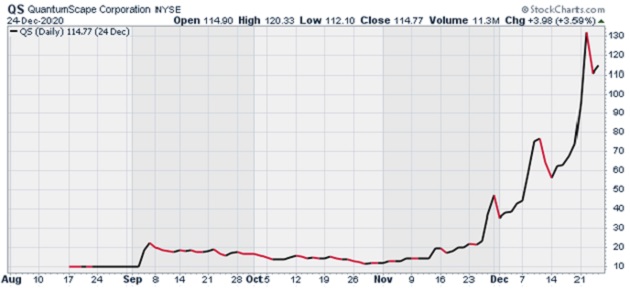

More recently, the same thing played out with “battery tech” techs. QuantumScape (QS) skyrocketed from $10 per share to over $130 between August 2020 and December of that year.

Source: StockCharts

Of course, this bubble popped too. QS nosedived 90% a little over a year after topping out.

That’s the trick…

You need to buy stocks before they enter a full-fledged bubble…

Unfortunately, that’s not possible with most stocks today.

Most industries are coming off multi-year bull markets.

Some stocks have gone up in almost a straight line since the 2008‒2009 global financial crisis.

But there is one industry that has been overlooked…

It hasn’t “bubbled” yet. But I believe a bubble is starting to form.

I’m talking about uranium—and in a minute I’ll share a simple way to cash in on the coming uranium bubble.

First, let’s look at a common misconception about uranium…

Uranium, which fuels nuclear power plants, is an “emotionally charged” resource.

Bring it up in conversation and many folks will get all worked up about the Chernobyl disaster or Fukushima. But disasters like those are extremely rare.

And they keep people from recognizing that uranium is one of the cleanest energy sources on the planet.

According to the International Panel on Climate Change, nuclear power produces less air pollution than solar, wind, or hydro.

This is why I called uranium my #1 way to profit off climate change in January.

In March, I doubled down on uranium… calling it my top play for today’s red-hot commodities market.

And I’ve only become more bullish on the industry.

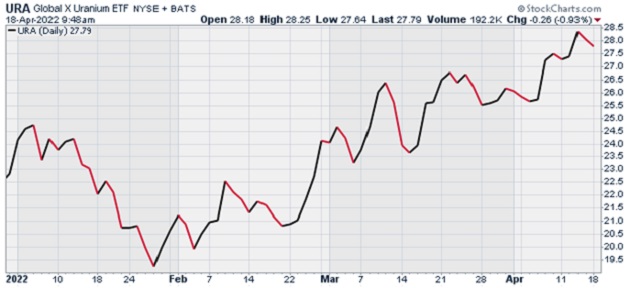

Uranium stocks have woken up in a major way…

The Global X Uranium ETF (URA), which invests in a basket of uranium stocks, has rallied 23% since the start of the year.

Source: StockCharts

This massive rally comes after a nine-year bear market in uranium stocks.

More important, uranium stocks are beginning to separate themselves from the broad market.

The chart below compares the performance of the Global X Uranium ETF (URA) versus the SPDR S&P 500 ETF (SPY), which tracks the S&P 500.

When this line is rising, uranium stocks are outperforming the broad market.

Below, we can see URA is emerging from a massive base against SPY.

Source: StockCharts

That suggests uranium stocks will be outperformers for years to come.

And I’m not the only investor who sees a very bright future for uranium…

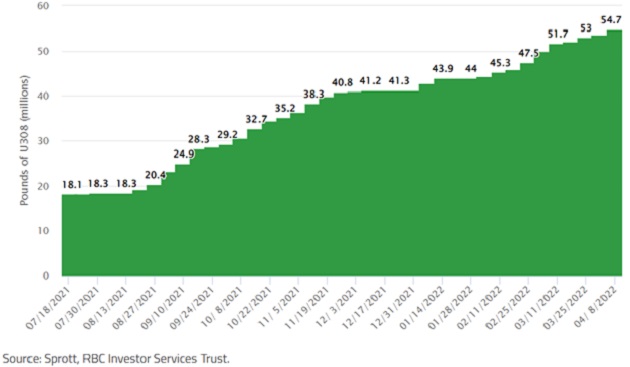

Sprott Asset Management thinks this uranium bull market is in its “second inning”…

Sprott is a global asset manager specializing in precious metals and other resource assets. Its Sprott Physical Uranium Trust is the world's largest physical uranium fund.

Last week, Sprott’s CEO told CNBC that the nuclear power industry is undergoing a “new renaissance.”

Specifically, countries around the world are adding nuclear power to the clean energy mix because renewables like solar and wind have intermittency issues. In other words, the sun needs to shine and wind needs to blow for them to reliably generate power.

He also noted institutional investors have bought 50 million pounds of physical uranium over the past 12 months through its Uranium Trust.

This is a huge deal. Utility companies, or the users of uranium, now must compete with investment institutions over the scarce supply of uranium.

In short, uranium is in high demand…

And everyday investors are starting to take note.

We know this because trading volumes in uranium stocks are soaring. If this continues, uranium has the potential to become the next big bubble.

And there’s still a lot of room for uranium stocks to soar…

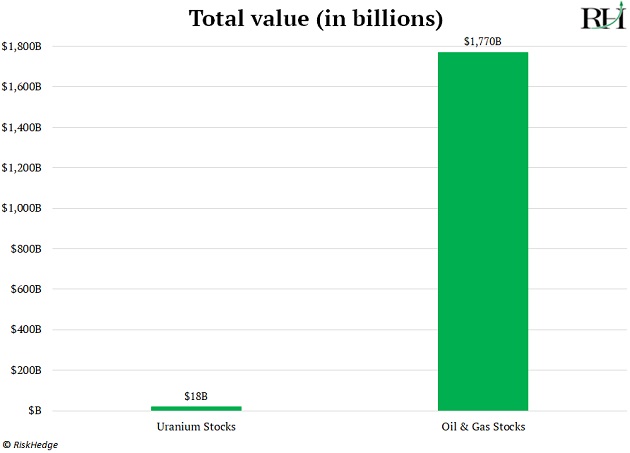

The chart below says it all. It compares the market values of US publicly traded uranium stocks with oil and gas stocks. You can see the uranium market is a tiny fraction of the oil market.

And it doesn’t look much different when you include non-US uranium stocks.

The total size of the publicly traded uranium market is less than $50 billion. For perspective, ExxonMobil (XOM), the world’s largest publicly traded oil company, is almost 10X bigger than the entire market of publicly traded uranium stocks!

The current uranium market situation reminds me of something an old mentor of mine, legendary investor Doug Casey, used to say…

When the market wants to get into gold stocks it’s like trying to force the contents of Hoover Dam through a garden hose. In the case of uranium stocks, it’s more like a soda straw. It’s a very small market.

Uranium stocks have the potential to become one of the most profitable bubble trades to come along in years.

You can easily take advantage of this setup by investing in the Global X Uranium ETF (URA).

But smaller, domestic uranium producers will likely produce even bigger gains.

3 Breakthrough Stocks Set to Double Your Money in 2022

Get our latest report where we reveal our three favorite stocks that can hand you 100% gains as they disrupt whole industries. Get your free copy here.

Related: Commodities Are Ripping Higher: Here’s My Top Way To Cash In