Written by: Walt Czaicki and Jillian Geliebter

Investors in US stocks enjoyed strong returns during 2020. But it may be time to look abroad. Global economic improvements, a weaker US dollar and attractive valuations bolster the case for US investors to consider initiating or increasing exposure to international equities in 2021.

US stocks rallied last year despite the pandemic’s harsh effects on the economy. The S&P 500 rose 18.4%, outperforming most major developed markets and capping a solid decade for US stocks. As a result, many US investors may feel comfortable having a home-country bias in their equity allocations and don’t see any urgency to add exposure to markets abroad.

But comfort zones can be deceiving. Regions outside the US are poised to benefit from major stimulus measures, while the weakening US dollar should make their stock markets more attractive for US-based investors. And since US large-cap stock markets have become highly concentrated in a small number of mega-caps, investing outside the US adds diversification benefits in companies with different return drivers that can’t always be found at home.

Economic Recovery May Support International Equities

Optimism is growing that the global COVID-19 crisis may come to an end during 2021. As the year began, new approved vaccines are being rolled out worldwide. While the coronavirus continues to spread, the eventual impact of growing vaccinated populations should allow more countries to reopen their economies and fuel a rebound of GDP growth.

In fact, real growth rates are projected to be especially robust in some key regions outside the US. For example, AB economists forecast that China’s economy will grow by roughly 8.0% in 2021, and global economic growth is expected to advance at a 4.9% pace this year following an expected decline of approximately 3.8% in 2020. And in key regions such as the euro area and Japan, fiscal and monetary stimulus packages have been implemented that are larger on a per capita basis than are those of the US, which could further spur the global economic recovery.

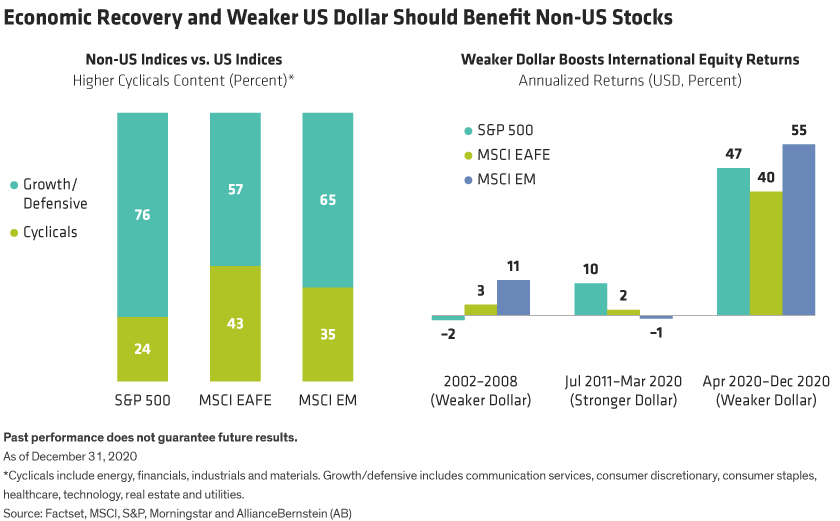

Economic growth may affect stock performance patterns. That’s because different markets are made up of different types of stocks. In the US, most of the S&P 500 consists of growth-centric and defensive stocks that are less sensitive to the economy, such as communication services, consumer staples and technology. Only 24% of the weight of the S&P 500 is in cyclicals stocks that are more sensitive to macroeconomic growth. In contrast, the MSCI EAFE Index of non-US developed-market stocks and the MSCI Emerging Markets Index have 43% and 35%, respectively, in cyclically sensitive stocks, such as energy, financials, industrials and materials (Display below, left).

Each region benefits from different growth drivers. Europe’s manufacturing sector still enjoys strong trade with China, while the US-China relationship remains strained; even under a new US administration, the trade and tech war with China won’t be easily untangled. China’s manufacturing data suggest that the country’s recovery is broadening, while Asian countries in general have resumed pre-pandemic activity faster than have Western peers.

Meanwhile, a weakening US dollar may also make non-US investments more attractive (Display above, right). By the beginning of 2021, the US dollar had lost about 10% of its value against a basket of currencies since peaking in April 2020. Our research suggests that US stocks have done better when the US dollar was strong, while periods of US-dollar weakness have benefited non-US stocks, particularly in emerging markets. Although it’s too soon to say for sure whether recent dollar weakness will continue, we believe stronger GDP growth in key regions outside the US, and the slimmer premiums offered from US Treasury yields versus foreign bonds, could support a strengthening of other currencies versus the dollar.

Diversifying Sources of Equity Returns

Beyond the appealing currency dynamics for non-US stocks, international markets offer additional structural attractions today. In particular, US stock markets have become highly concentrated in a small number of mega-cap stocks, such as Amazon.com, Apple and Facebook. By the end of 2020, the market value of the 100 largest US companies was 33% greater than the entire value of non-US markets, as measured by the MSCI EAFE Index. In non-US markets, returns and market weights have generally not been as concentrated.

Why does this matter for investors? First, the exceptional performance of select US mega-caps has also driven up their weights in key indices. While many of these companies have solid growth businesses, developments ranging from increased regulatory scrutiny to economies reopening (think stay-at-home versus going-out stocks) may trigger a reversal of sentiment toward these stocks, which could hurt investors who piled too heavily into the group. Second, the more diverse nature of non-US returns could provide more opportunities for investors in an expanding recovery.

MSCI EAFE Shows Signs of Recovery

Indeed, non-US stocks perked up toward the end of 2020. The MSCI EAFE Index trailed the S&P 500 from January through mid-November 2020. But as news about the efficacy of COVID-19 vaccines came to light, from November 9 through December 29, the MSCI EAFE advanced by 11.8%, outpacing the S&P 500 by about 450 basis points. And based on price/forward earnings, valuations of markets outside the US remain relatively more attractive than US stocks. For example, European stocks and Japanese stocks are well below their 20-year average discounts, with valuations that are about 14% lower than the MSCI World Index at the end of 2020 (Display). So, we believe there is still ample opportunity to rebalance into international equities.

Regional market leadership is not constant. While US stocks have done well in recent years, stocks in emerging markets and other developed markets have outpaced American indices in the past. For example, non-US stocks outperformed US stocks in eight of 11 calendar years from 2002 to 2012. What’s more, over the past decade, a large proportion of the world’s best-performing stocks were found outside the US, even in good years for US markets. For example, even in 2020, when the US market performed exceptionally well, 96% of the world’s 50 best-performing stocks were listed abroad (Display). Finding stocks with the best return potential requires a selective, active investment approach, in our view, especially given the wide dispersion of business performance, earnings and valuations wrought by the pandemic.

The start of the year is a good time to reexamine equity allocation plans. As hopes for a broadening recovery gain traction, don’t assume that last year’s winning stocks will stay on top, and don’t get too comfortable sticking with domestic US stocks. Strategic portfolios that are suitable for different risk appetites and long-term financial goals can help investors stay within their comfort zones while capturing promising sources of return potential in carefully selected stocks from around the world.

Related: Could Chinese Bond Defaults Benefit Investors in the Long Run?